Ethereum noticed a current value restoration after dipping in early April.

Nearly all of ETH inflow into the trade of derivatives suggests potential hedges or quick positions, traditionally earlier value declines.

International financial uncertainty is growing Ethereum’s unstable outlook regardless of current earnings.

Ethereum is making headlines once more. After a pointy drop earlier this month, the world’s second largest cryptocurrency exhibits indicators of restoration. On April 9 alone, ETH jumped to eight.24%. It has risen by one other 1.5% over the past 24 hours. Nevertheless, contemporary on-chain information has induced some issues. There was a big and strange development in ETH to trade derivatives.

Is that this one other dip warning signal?

Rocky April for Ethereum

Ethereum began the month at $1,821.51. On April 2nd, the worth was briefly talked about at $1,957.94, however by the tip of the day it had returned to $1,794.51.

From April fifth to eighth, ETH fell by greater than 18.86%. Nevertheless, since April 9, the market has proven indicators of restoration with a revenue of seven.82%.

The second week of April has settled down. Between April seventh and thirteenth, Ethereum rose 2.83%. This was a slight enchancment in comparison with the earlier week.

Nonetheless, over the previous seven days, general earnings have been solely 0.1%, indicating that the market stays cautious.

Massive inflow of derivatives: pink flags?

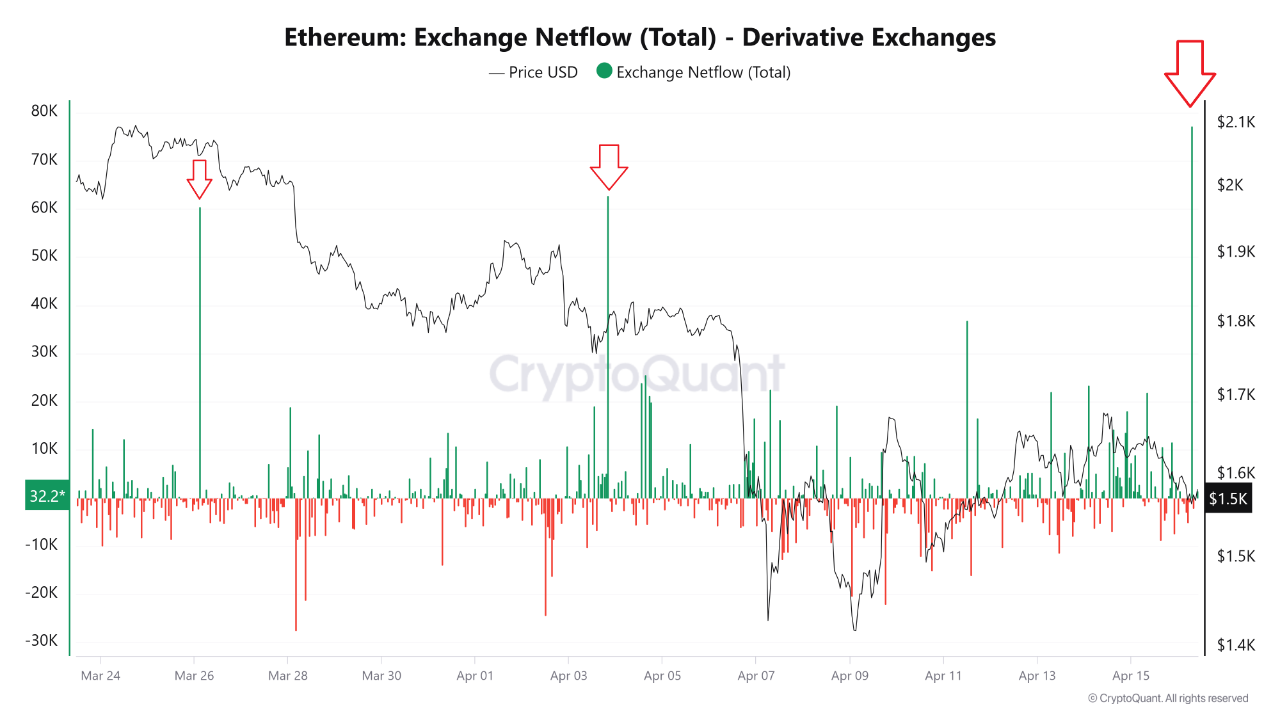

Yesterday, greater than 77,000 ETHs have been moved to spinoff exchanges, in line with the Ethereum Trade Netflow Chart. That is the most important each day inflow seen in March and April.

On the identical day, the worth of the ETH fell from $1,588.44 to $1,577.07. At one level, it even hit a low of $1,537.28.

Such inflow normally means that merchants are making ready for draw back actions by hedging their positions or opening shorts.

This isn’t the primary time I’ve seen this sample. Equally, an inflow occurred on March twenty sixth and April third. In each circumstances, the market responded with a sudden revision.

From March twenty fifth to thirtieth, ETH fell 13.05%. One other revision from April 4th to eighth continued, with the market down 18.92%.

Tariff stress and cipher volatility

Worth fluctuations in Ethereum are additionally formed by bigger international points. The US authorities’s aggressive tariff coverage underneath the Trump administration has induced turbulence throughout main asset lessons, together with cryptocurrencies. Presently, the coverage has a 90-day suspension, however uncertainty continues to have an effect on buyers’ emotions.

Since April 1, the general Crypto market has declined by 0.38%, whereas the AltCoin market has declined by 4.42%. Ethereum alone noticed a drop of a minimum of 12.56% over the identical interval.

Ethereum Market Outlook: What Merchants Ought to See Subsequent

In recent times, Ethereum has elevated by 90.8% in 2023 and 46.1% in 2024. Nevertheless, this yr has begun roughly. Within the first quarter of 2025, ETH fell 45.3%. This contrasts with the primary quarter 2024 and first quarter 2023, when the market rose 59.8% and 52.4% respectively.

Ethereum exhibits a short-term restoration, however a significant trade of influxes into derivatives is a possible warning signal. Coupled with ongoing international financial tensions, the short-term outlook stays unsure.

For now, Ethereum buyers have to be cautious about each market charts and international headlines.