Right this moment’s Ethereum Value: $1,580

- Ethereum ETF has seen a 60% lower in complete internet property.

- Justin Solar stated Tron wouldn’t promote its eth stake amid the worth decline.

- Galaxy Digital has deposited $79.37 million in ETH with Binance and Coinbase over the previous 5 days.

- ETH has maintained a downward pattern since December amid overselling circumstances for technical indicators.

Ethereum (ETH) traded for below $1,600 on Thursday after the overall internet price of US Spot Ether ETFs plummeted by 60%. In the meantime, Tron founder Justin Solar stated he is not going to promote his ETH Holdings regardless of a sustained downward pattern within the costs of prime altcoins.

The solar is closely on the decline in Ethereum amid rising ETH ETF spill

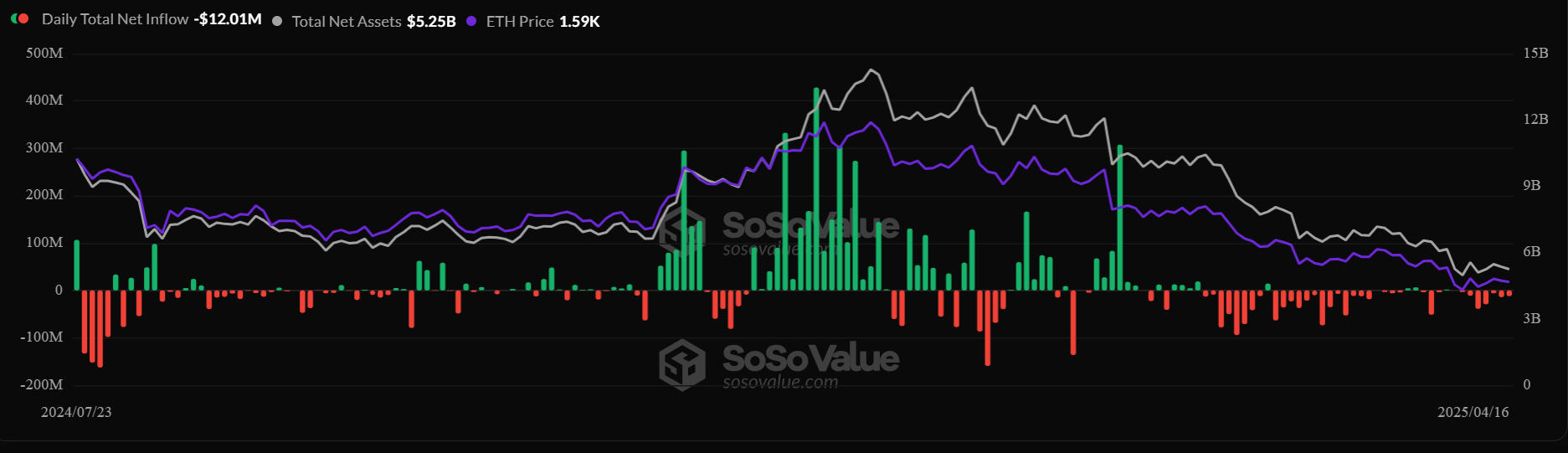

For every Sosovalue information, US Spot Ether Change-Traded Funds (ETFs) continued their adverse pattern after reducing $12.01 million on Wednesday.

ETH ETF has seen internet spills of $909 million since Trump’s tariffs have been launched. The low costs of ETH have plummeted over 60% of complete internet property, transferring from a file excessive of $14.28 billion in December to $5.25 billion on Wednesday. The sustained leakage sign elevated institutional risk-off sentiment and hindered ETH worth development.

US Spot ETH ETF Netflow. Supply: SosoValue

Which means issuers equivalent to Constancy, Bitwise, Grayscale, and 21Share are looking for approval from the Securities and Change Fee (SEC) to permit staking inside ETF merchandise. With approval from the SEC, buyers will earn round 3% on their ETH ETF holdings, which might decelerate gross sales strain on the product.

In the meantime, with x put up On Thursday, Tron founder Justin Solar identified that he is not going to promote ETH Holdings regardless of the weak worth motion of prime altcoins over the previous few months. As a substitute, he emphasised that Tron will proceed to work with Ethereum builders.

“ETH is presently at a low worth, however we’re not planning to promote ETH holdings,” Solar writes to X.

Solar is a significant investor in ETH and has elevated his holdings a number of instances over the previous yr. Solar reportedly transferred a considerable amount of ETH to HTX exchanges on the This fall’24, however he nonetheless maintains the fats ETH steadiness in some staking protocols. Whale wallets that will belong to the Solar maintain over 168,000 Steths per Arkham information.

Solar’s feedback comply with potential gross sales actions from Digital Asset Agency Galaxy Digital, with 49,681 ETH price roughly $79.37 million in Binance and Coinbase over the previous 5 days. A number of ETH whales have additionally surrendered throughout the previous month, as a result of affect of Trump’s tariffs in the marketplace.

Ethereum worth forecast: ETH continues downtrend amid oversold technical indicators

Ethereum noticed a $23.1 million futures liquidation over the past 24 hours for every Coinglass information. The full quantities of lengthy and quick liquidations are $12.52 million and $10.58 million, respectively.

ETH has been prolonged since December sixteenth, extending journey inside main descending channels for greater than 4 consecutive months. It has been marking ETH since its launch in 2017 the longest month downtrend.

ETH/USDT Weekly Chart

Failures beneath the decrease boundary of the channel can speed up the discount in ETH and result in immeasurable yield. Nevertheless, breaking out above the channel’s higher restrict and regaining a $2,000 key degree could lead on ETH right into a bullish pattern.

The relative energy index (RSI) is about to enter the realm the place it was offered, however the stoch oscillator (Stoch) has been on sale since late February. Transferring Common Convergence Divergence (MACD) posts two consecutive regression histogram bars, indicating slight weak spot in bearish momentum.