Simply as Bitcoin (BTC) goes by a nerve-racking buying and selling day, Michael Saylor has stepped into the highlight. In at present’s new submit, the CEO of Technique shared a photograph generated by his AI on a chess board and captioned, “Bitcoin is chess.”

Importantly, the timing of the submit coincides with rising monetary market uncertainty as all the things awaits recent commentary from Federal Reserve Chair Jerome Powell.

Chess is, in any case, about construction and technique, not panic and prediction. Saylor has mastered this lengthy recreation, citing equity. Technique, the corporate he chairs is 528,185 BTC, about $443.1 billion, because it holds one of many largest Bitcoin Treasury ministries on the planet.

The typical buy worth is $67,458, and the present market is situated in a wholesome revenue zone of round 24.35%.

Bitcoin is chess. pic.twitter.com/pnookuofzj

– Michael Saylor (@saylor) April 16, 2025

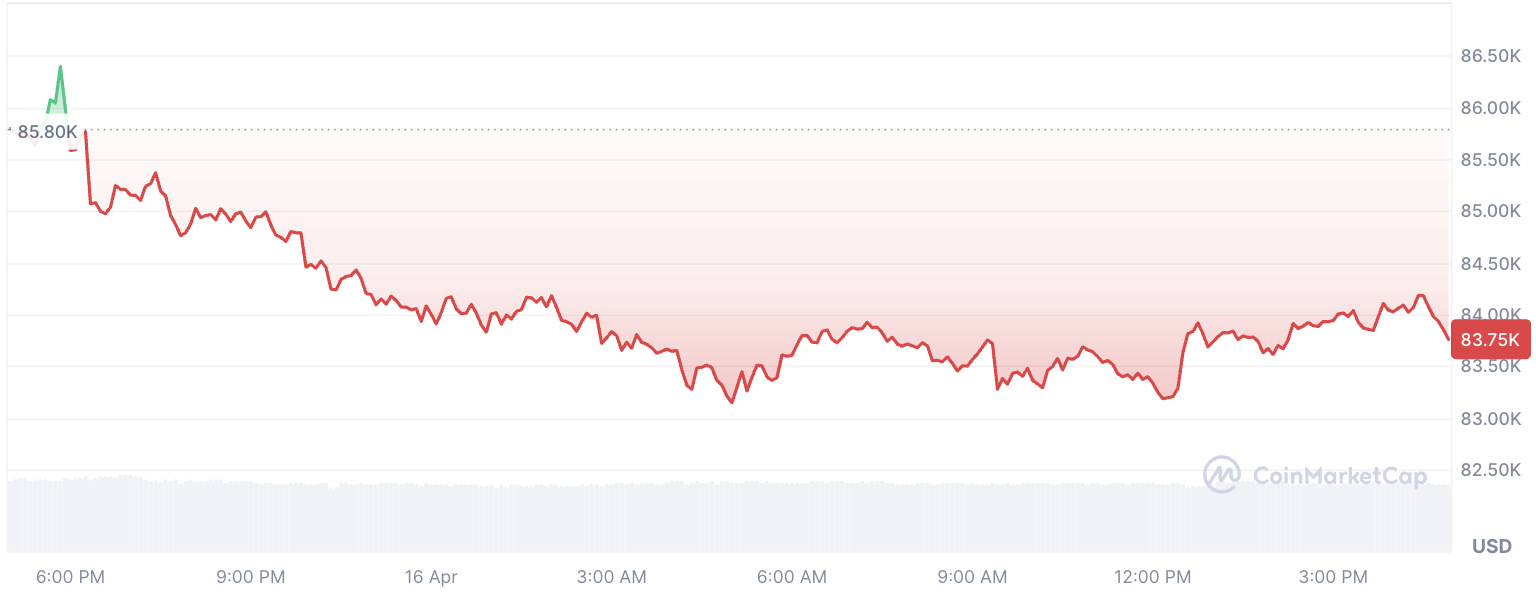

However at present it’s unsettling that controls the dialog, not revenue. The Bitcoin worth chart for April 16 exhibits all of the basic indicators of nervous buying and selling conduct. From the reset of the buying and selling session, Bitcoin bounced irregularly between $83,100 and $84,300, ultimately touchdown round $83,909.

This sample reveals nervous feelings: no sharp reversals, short-lived gatherings, and no clear directional beliefs. It is not a crash, it isn’t a breakout, it is only a nervous one.

It’s no coincidence that this environment coincides with Powell’s anticipated commentary, who is predicted to the touch on rates of interest, liquidity circumstances and macro indicators that may wavy danger belongings. In that body, Bitcoin is about much less about Fed timing and longer than noise, as seen by the Saylor lens.