Ethereum (ETH) continues to fall under the $2,000 mark, a degree that has not been recovered since March twenty eighth. Regardless of makes an attempt to stabilize, latest information reveal a rise in ETH concentrations amongst whale wallets, together with a sustained debilitating development indicators just like the EMA line.

On the similar time, retailers and medium-sized holders are progressively shedding their share, additional distorting possession over bigger gamers. This mixture of lowered retail participation and maelstrom domination could make ETH extra weak to sharp corrections when feelings change.

ETH whale holdings rise for the primary time in 9 years, elevating considerations about centralization

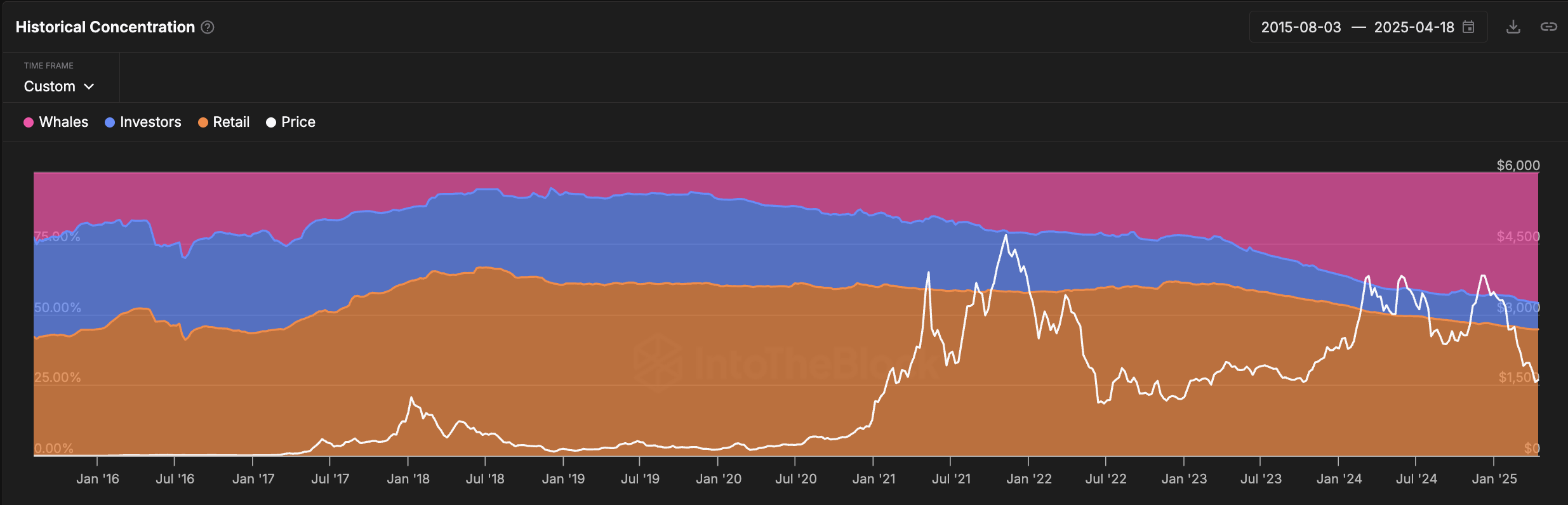

The quantity of ETH held by whale addresses (feed that controls greater than 1% of complete circulation provide) has reached its highest degree since 2015, sitting at 46%.

This means a big change in Ethereum possession information because the whales surpassed retail buyers’ holdings on March tenth and have continued to extend their share since. As compared, each investor-level addresses housed between 0.1% and 1% of provide and retail wallets below 0.1% have seen a decline in ETH share.

The soar from 43% to 46% in just some months displays a pointy accumulation development among the many largest holders, suggesting a rise in ETH concentrations in lesser palms.

ETH historic focus with several types of wallets. Supply: IntotheBlock.

Whales are normally representing institutional buyers, funds, or early adopters, and their actions can have a big affect on costs as a result of quantity they handle. Investor-level addresses usually replicate rich or small establishments, whereas retail addresses embody on a regular basis merchants and holders.

Whereas some could contemplate whale holdings to be a vote of confidence, as giant holders start offloading additionally will increase the danger of sudden volatility.

As retail and investor participation shrink, the market might change into extra weak and weak to the sharp, surprising worth actions pushed by a number of dominant gamers.

Whales holding 1,000-100,000 ETH now handle $59 billion

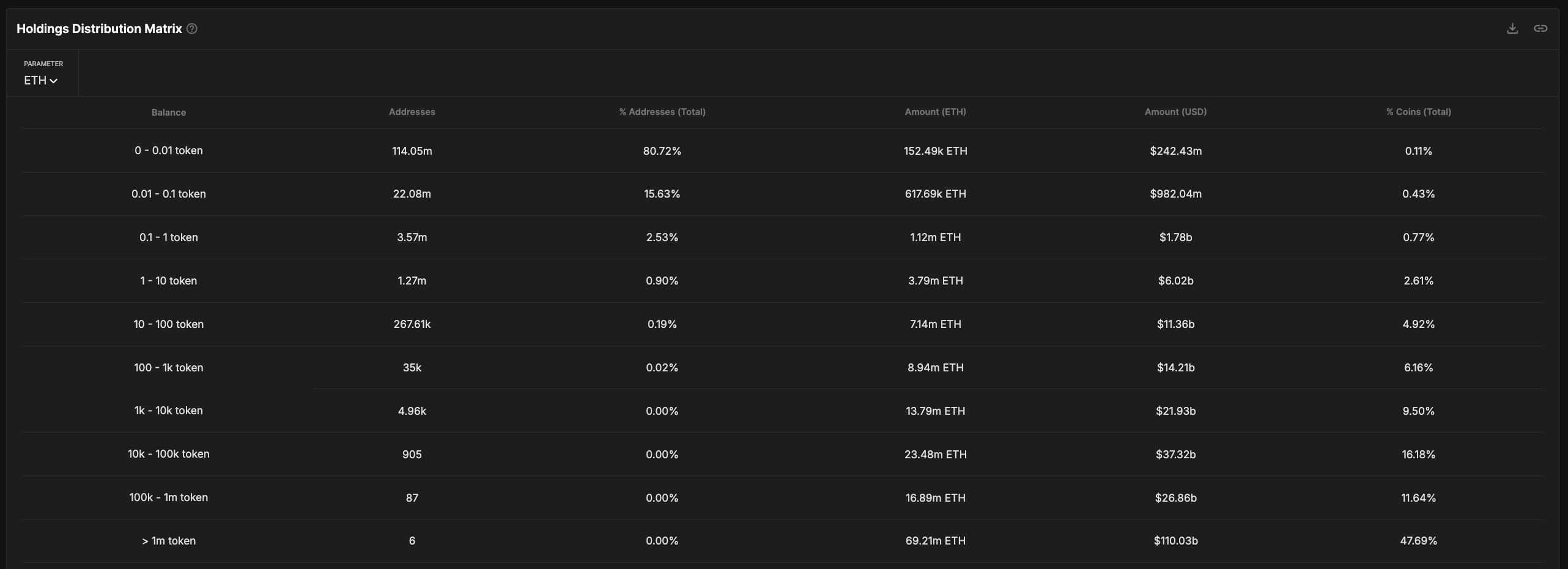

Evaluation of the ETH Holdings distribution matrix reveals indicators of deepening focus.

In the event you exclude addresses of greater than 100,000 ETH, they’re additionally linked to central exchanges, however Western addresses that maintain between 1,000 and 100,000 ETHs handle round $59 billion at ETH, which accounts for round 25.5% of the circulation provide.

The group is steadily accumulating extra provide of the community, strengthening its energy shift in direction of bigger entities working outdoors the change, however nonetheless has a serious affect available on the market. Just lately, Galaxy Digital moved $100 ETH millionereum raises the query about whether or not it’s a strategic shift or a sale sign.

ETH Holdings Distribution Matrix. Supply: IntotheBlock.

This development could also be interpreted as strategic positioning by assured holders, however it exposes Ethereum to vital adverse facet threat.

With greater than 1 / 4 of provide concentrated in these whale palms, tailor-made or panic-driven gross sales may cause a sudden worth drop, particularly in environments the place retail participation is weakened.

This degree of focus, moderately than an indication of long-term stability, could make the ETH market extra weak and extra more likely to change into volatility if these holders begin spinning capital into different property.

Bearish EMA construction exposes ETH to stress

Ethereum’s EMA line continues to flush the Bearish sign, with the short-term common nonetheless situated under the long-term common, indicating downward momentum.

If a brand new repair happens, Ethereum can first take a look at assist for $1,535. A breakdown under that degree opens the door to a deeper decline to $1,412 and even $1,385.

If these assist fails to be retained both, Ethereum is dangerously near the $1,000 mark, with some analysts flagging it as a possible downside goal if an expanded market correction happens.

ETH worth evaluation. Supply: TradingView.

Nonetheless, a bullish reversal is not solely out of the query. If stress returns and Ethereum regain short-term momentum, resistance ranges could possibly be examined at $1,669.

The breakouts above are key technical alerts and will push Ethereum costs as much as $1,749, and even $1,954.

Nonetheless, as Emma continues to be leaning in direction of the draw back, the bull nonetheless has a burden to show that the momentum has modified crucially.