The Ethereum ETF closed for an additional week within the crimson amid persevering with his investor’s hesitation, recording a web spill.

Specifically, there was no web influx for the week for the reason that finish of February.

Ethereum ETFs are going through secure spills

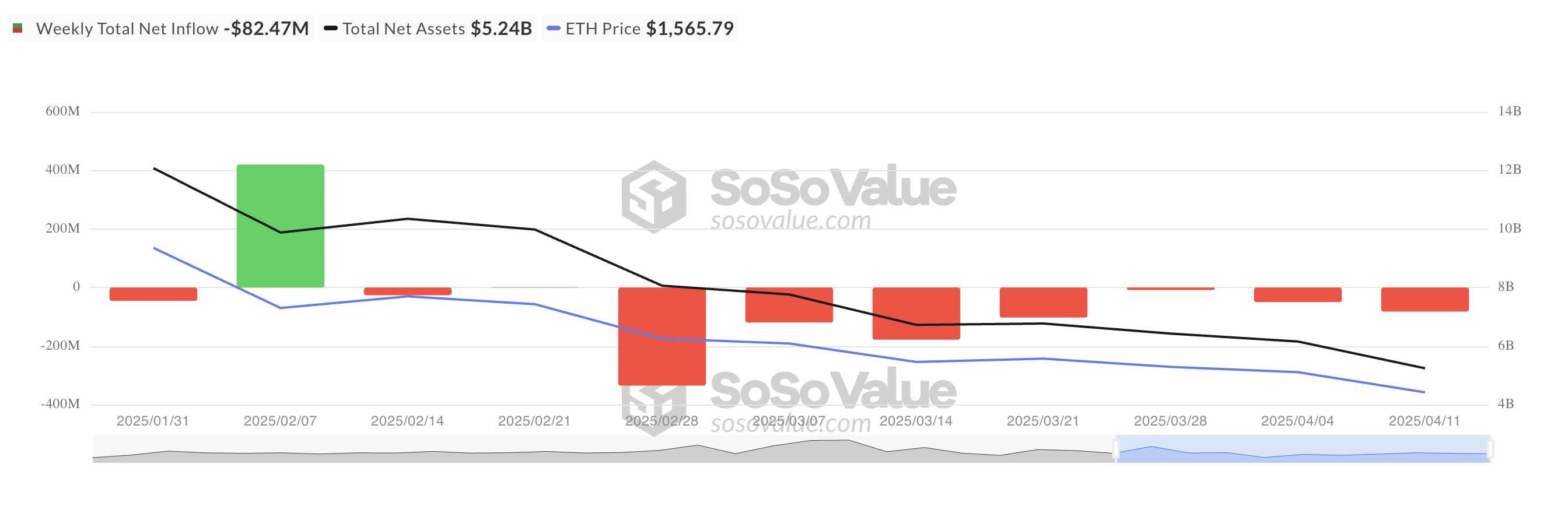

The Ethereum Backed ETF has recorded a web outflow for seven consecutive weeks, highlighting its sustained institutional he on belongings.

This week alone, web outflows from Spot ETH ETFs totaled $82.47 million, a 39% surge from the $49 million recorded within the earlier week’s outflow.

All Ethereum spot ETF web circulation. Supply: SosoValue

The promoting strain on cash has skyrocketed because the institutional presence within the ETH market has steadily declined.

Over the previous week, ETH costs have fallen by 11%. A secure outflow from coin-backed funds means that downward momentum may proceed, growing the probabilities of costs falling beneath $1,500.

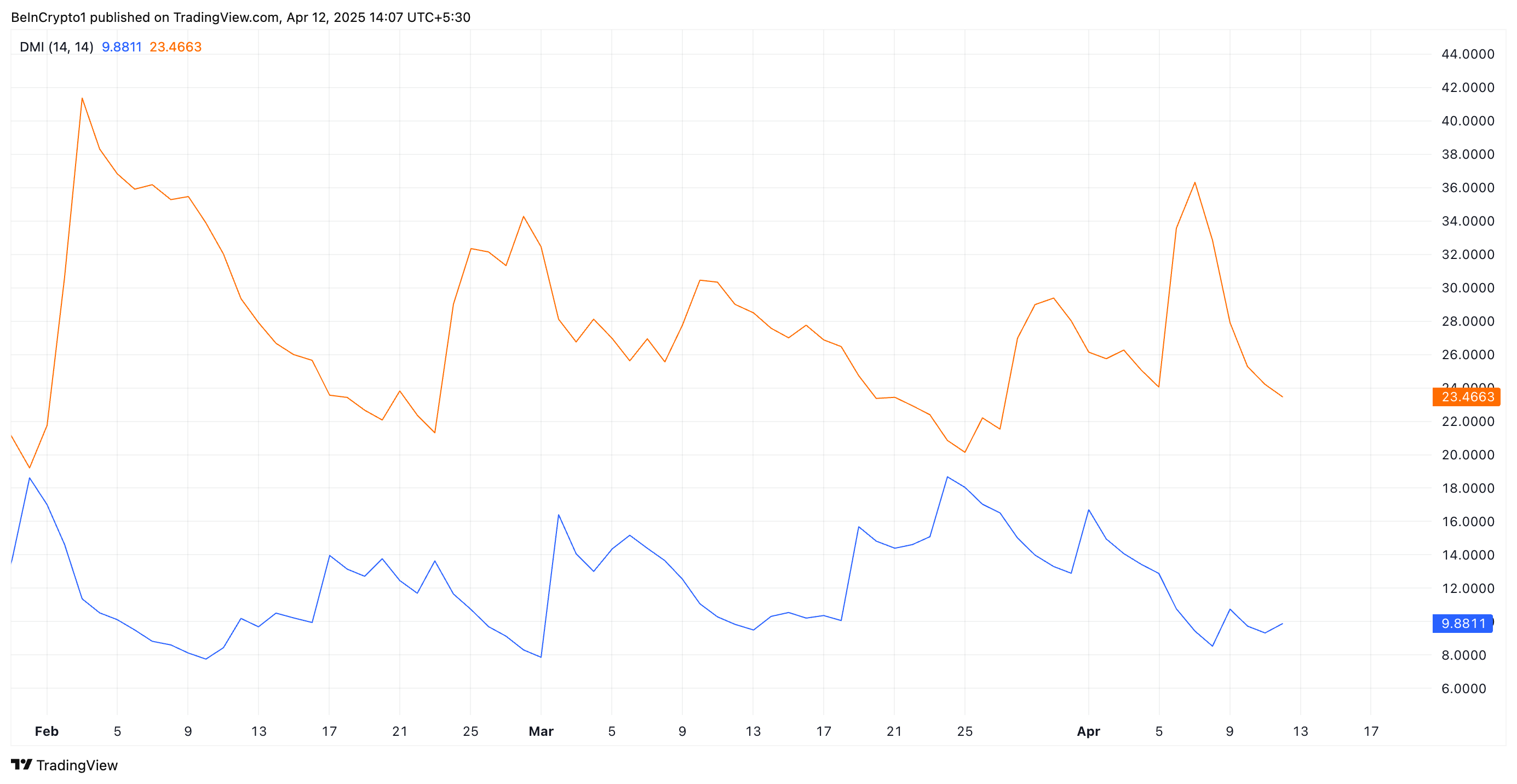

The value listing reveals that expertise indicators stay bearish, confirming growing strain from the market’s vendor aspect. For instance, throughout urgent, the measurements from the directional motion index (DMI) of ETH point out the optimistic directional index (+DI) beneath the adverse directional index (-DI).

ETH DMI. Supply: TradingView

The DMI indicator measures the power of an asset’s worth traits. It consists of two rows: +DI, which represents the upward worth motion, and -DI, which represents the downward worth motion.

Like ETH, when +DI is positioned below -DI, the market tends to be bearish, and downward worth actions dominate market sentiment.

Ethereum costs may fall beneath $1,500

The shortage of institutional capital may decelerate important rebounds in ETH costs and will additional attenuate the short-term outlook for restoration. If demand is tilted additional, ETH can get away of the slender vary and comply with the downward pattern.

On this state of affairs, Altcoin may fall beneath $1,500 and attain $1,395.

ETH worth evaluation. Supply: TradingView

Nonetheless, if ETH witnesses a optimistic change within the surge in sentiment and demand, its worth may rise to $2,114.