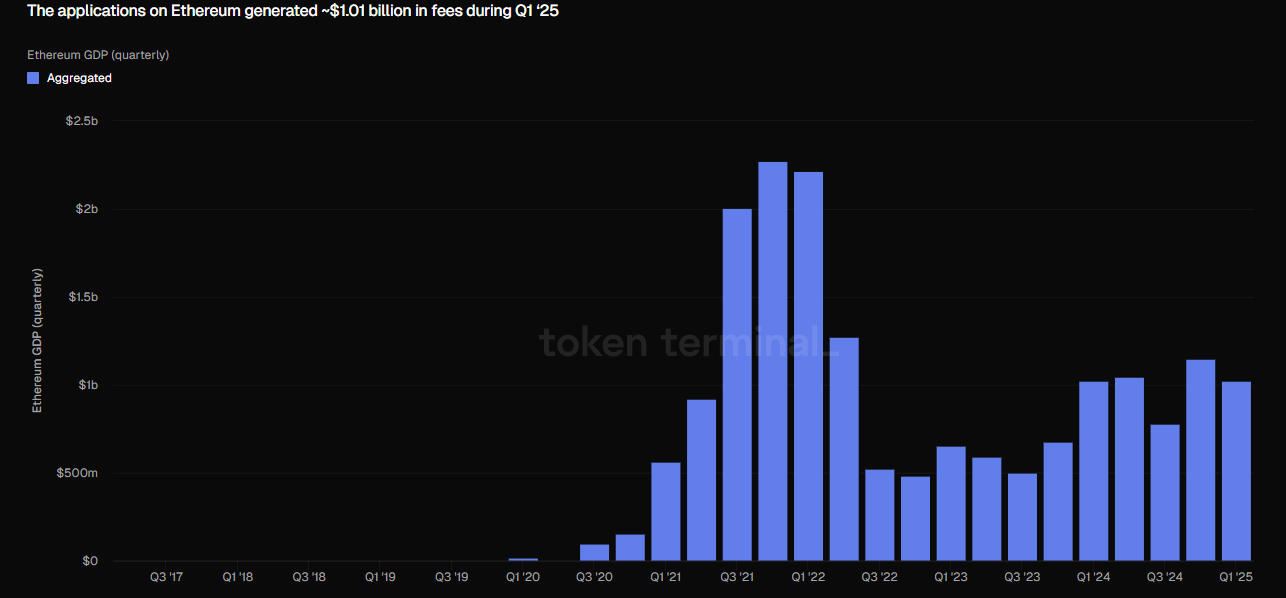

Ethereum Dups led the pack within the first quarter of 2025, producing greater than $1 billion in charges, far surpassing opponents comparable to bases, BNB chains and arbitrum, highlighting Ethereum’s continued dominance in decentralized utility income.

Ethereum Dup surpasses base and BNB chains in quarterly charges

In accordance with Token Terminal, Ethereum continues to solidify its place as a significant platform for distributed functions (DAPPS) (DAPPS).

A lot behind Coinbase’s Layer 2 chain, the category took second place at $193 million. The BNB Chaindap continued intently, gathering $170 million, bringing the Arbitrum ecosystem to $73.8 million. Avalanche’s C-chain concluded the highest 5, with its Dapps producing a price of $27.68 million.

Supply: Token Machine

This knowledge highlights Ethereum’s continued management in consumer engagement and transactional actions inside distributed finance and Web3 utility areas. Though Layer 2 and different chains have acquired positions, Ethereum’s established infrastructure and sturdy developer ecosystem stay essential drivers of its market power.

As DAPP utilization and price technology emerged as key indicators of community utilities and adoption, Q1 outcomes present that Ethereum nonetheless units the tempo of the increasing blockchain ecosystem.