Binance’s checklist development for 2025 attracts a troublesome image for buyers chasing the newly launched tokens. Of the 27 tokens added to the platform this yr, solely three have proven constructive returns by April 1st. This reveals a failure fee of 89%.

Many of those tokens have fallen between 70% and 90% from the itemizing worth. Nonetheless, the three coinforms, crimson and layers defied the development, leading to significant advantages.

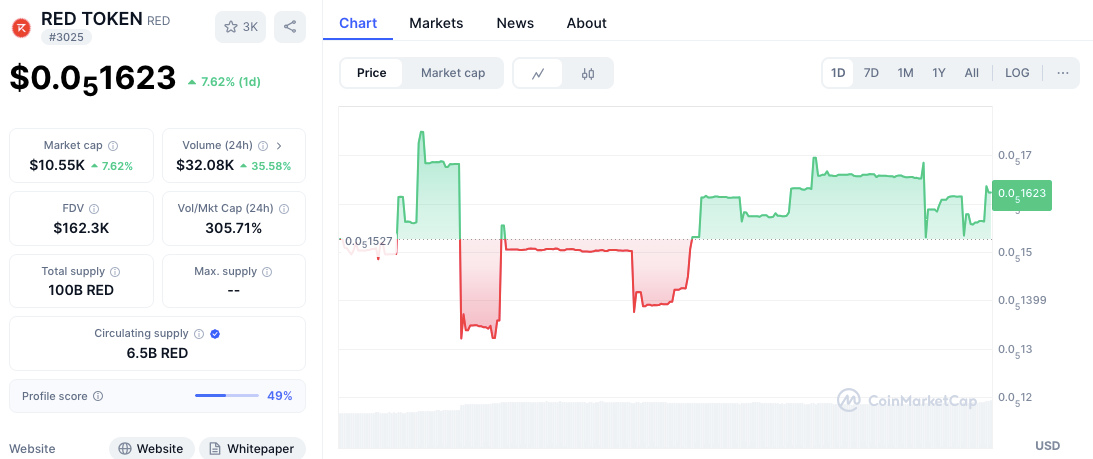

Kinds (types) see unstable advantages, however face liquidity

Type has returned greater than 29% since its itemizing on March 19, rising from $1.74 to $2.25. Regardless of this development, latest worth motion talks about one thing else. On April 1st, the shape traded for simply $0.0002777. It rose nearly 65% in 24 hours, however every day volumes fell 12.5% to $313,000. This means the opportunity of chopping off the power of quantity and worth.

Supply: CoinMarketCap

What’s extra, it has a totally diluted valuation of $1.38 million and a market capitalization of simply $345,000. This implies low liquidity trades, which is liable to unstable worth actions. Help is close to $0.000165, however $0.00050 acts as a resistance.

Costs are built-in between $0.00020 and $0.00030. Breakouts above $0.00032 may trigger new momentum, whereas drops beneath $0.000165 may trigger losses.

Associated: Pink Crypto Market: ICP, Chain Hyperlink, Optimistic Costs Gradual – Analyst Weight at Main Value Ranges

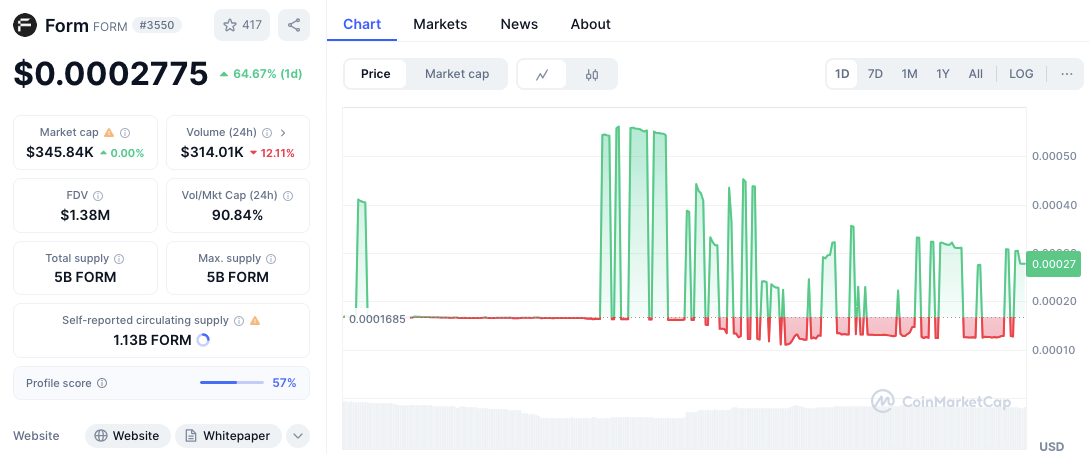

Pink tokens acquire momentum

Pink has risen 23.43% since its checklist on February twenty eighth. It presently trades at $0.0516, with every day quantity exceeding 32% to 31.6K. The token’s market cap stays very low at $10.58K, however the market-to-market cap ratio is over 300%. This implies excessive hypothesis and skinny fluidity.

Importantly, worth help was fashioned at $0.0512 and $0.0500. Resistance is near $0.0540 and $0.0570. Costs have lately been destroyed past the mixed vary and at the moment are even larger. Upkeep over $0.0520 means that you can open a room for a $0.057 check. Nonetheless, a breakdown of lower than $0.0512 may lead to pullbacks showing in the direction of a psychological degree of $0.0500.

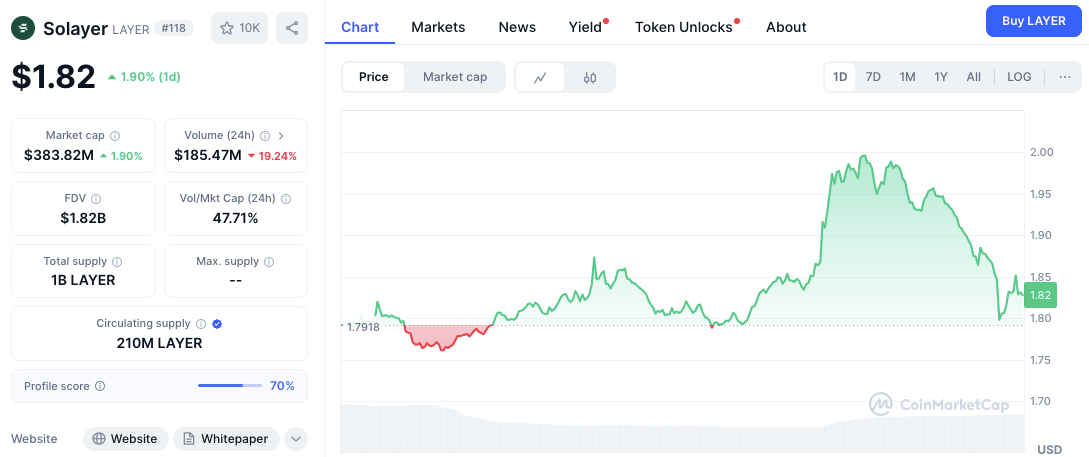

Solayer (Layer) holds firmly past key help

Layer has offered the perfect return on the brand new checklist with a revenue of 42.41% since February eleventh. It trades at $1.84 with a market capitalization of $386.7 million, incomes a wholesome quantity of $100 million a day. Quantity has dropped by 19%, however this development stays bullish.

Supply: CoinMarketCap

Associated: Mana, Matic and GMT can shortly rise as chart patterns look promising

Help ranges are $1.79 and $1.75, with resistance near $1.95 and $2.00. If the value is above $1.80, the layer can try a breakout. Nonetheless, if it falls beneath $1.79, gross sales stress may very well be spurred.

Disclaimer: The data contained on this article is for data and academic functions solely. This text doesn’t represent any form of monetary recommendation or recommendation. Coin Version shouldn’t be chargeable for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.