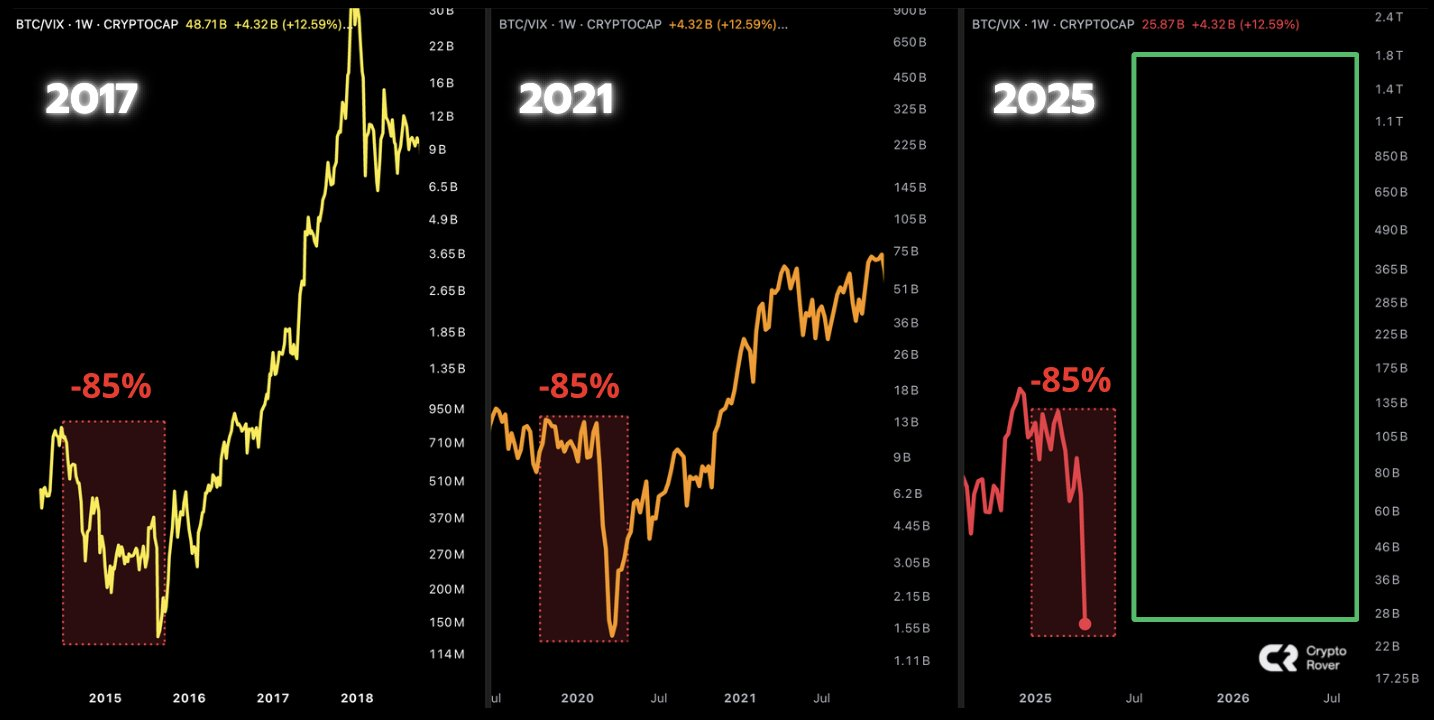

The present cycle of Bitcoin exhibits sturdy similarities with the structural reset seen in each 2017 and 2021.

Key market metrics akin to the connection between Bitcoin and market volatility (BTC/VIX ratio) and the full crypto market capitalization on the weekly chart present comparable alignments to these seen within the neighborhood of earlier vital market shifts. These main worth changes previously served as greater than only a recession. They successfully reset the market earlier than the key upward pattern that adopted started.

Bitcoin Script: How Previous Crash Units Traditionally New Highs

Wanting on the massive image, Bitcoin’s worth historical past reveals its recurring multi-year construction. Robust upward ft, pushed by widespread pleasure, in the end finish with a sudden worth drop (traditionally it will possibly additionally exceed 80%-85% from the height).

Historic Bitcoin Market Cycle Comparability (2017, 2021, and 2025)

Following these huge drops, a quiet interval of traditionally starting when devoted, long-term buyers steadily started shopping for once more, laying the inspiration for the subsequent essential climb. Examples embody lows that reached round $200 since 2013, practically $3,000 since 2017, and round $16,000 after peaking 2021.

The construction for 2025 exhibits a well-recognized rhythm. After exceeding $100,000, Bitcoin fell beneath $80,000, pushed by macroeconomic stress and elevated geopolitical dangers. Importantly, this pullback introduced costs to zones the place vital purchases have occurred in previous cycles and will put together the bottom for the subsequent upward pattern.

Bitcoin Value Examine: Can BTC break key resistance to verify the sample?

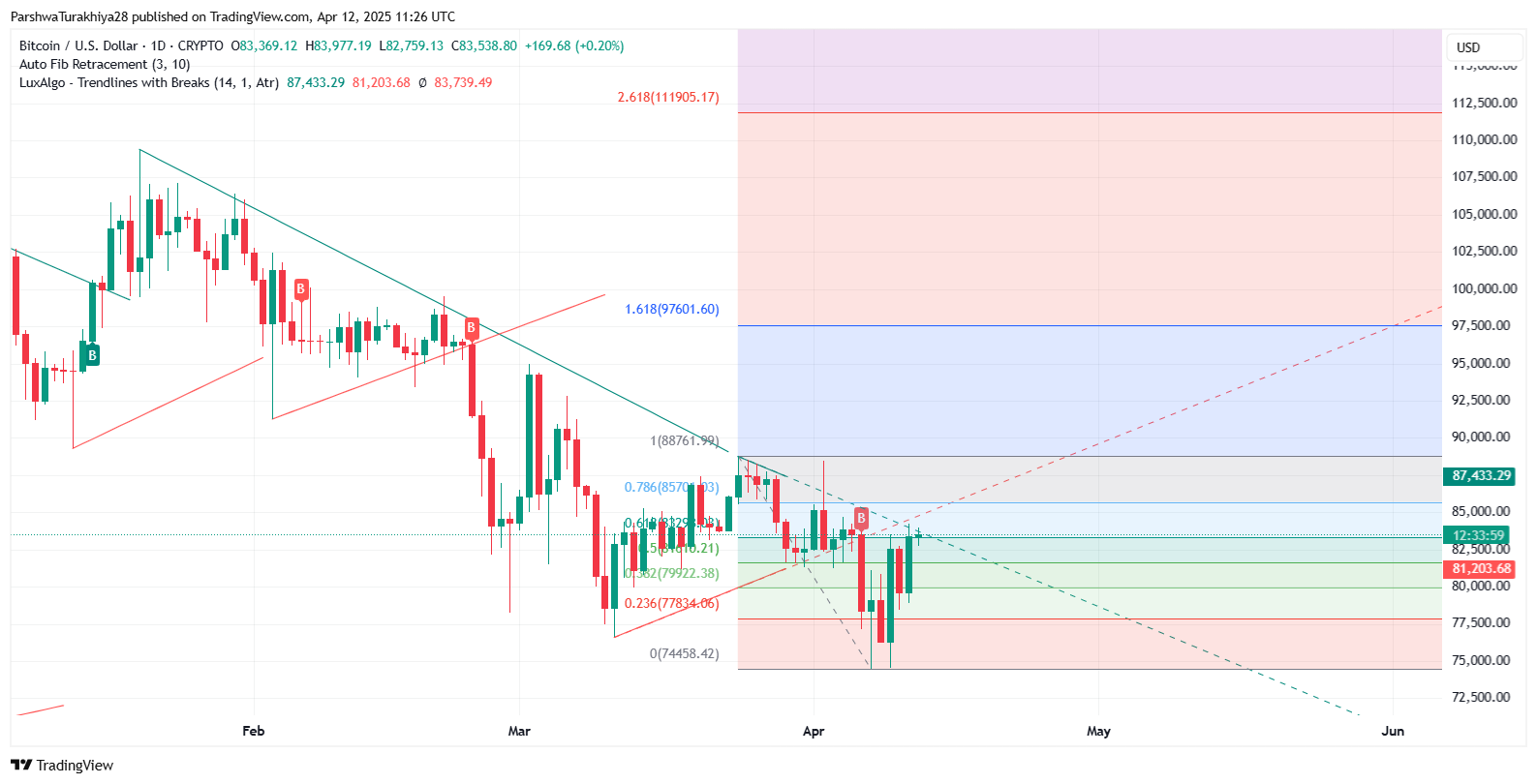

BTC/USD chart (March 2025 – April 2025)

Bitcoin is at present buying and selling practically $85,050, recovering $74,436 from its latest low. It has returned to round $74,436 from its latest low. On the four-hour chart, costs have been pushed past the descending trendline. It’s at present concentrated between $84,200 and $85,700.

The relative power index (RSI) is situated at about 59.58, suggesting that average buying power exists with out excessively overheating the market. Fibonacci’s retracement ranges present clear objectives: $85,700 (0.786), $88,700 (1.0), and $97,600 (1.618) are potential $111,900 (2.618) if traits are confirmed.

A each day closure exceeding $88,000 is staying as a crucial threshold for bull verification. On the draw back, the primary help degree is $82,000, adopted by $79,900 and $77,800.

For historic guides, can Bitcoin already be constructed in the direction of $150,000?

The market construction, coupled with on-chain indicators and historic cycle patterns, means that Bitcoin could also be within the stress accumulation section prior to a different growth.

Nonetheless, affirmation will depend upon quantity, breakout power above $88,000, and sustained return of facility purchases. As historical past repeats itself, the trail to Bitcoin’s $150,000 could already be ongoing.

Disclaimer: The knowledge contained on this article is for data and academic functions solely. This text doesn’t represent any form of monetary recommendation or recommendation. Coin Version is just not accountable for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.