Ethereum (ETH) faces elevated strain from whale exercise as giant holders proceed to dump a good portion of their holdings.

This ongoing sale has are available in a difficult season for cryptocurrency, with Ethereum tackling a decline in value efficiency.

In line with Beincrypto knowledge, ETH has been depreciated by 51.3% for the reason that begin of the yr. Macroeconomic elements have been closely and closely throughout the crypto market, however Ethereum’s battle is especially pronounced. Actually, final week, Altcoin hit a low that has not been seen since March 2023.

Nonetheless, the suspension of tariffs brought about a modest restoration in ETH quickly after. On the press convention, Ethereum was buying and selling at $1,623.

Ethereum value efficiency. Supply: Beincrypto

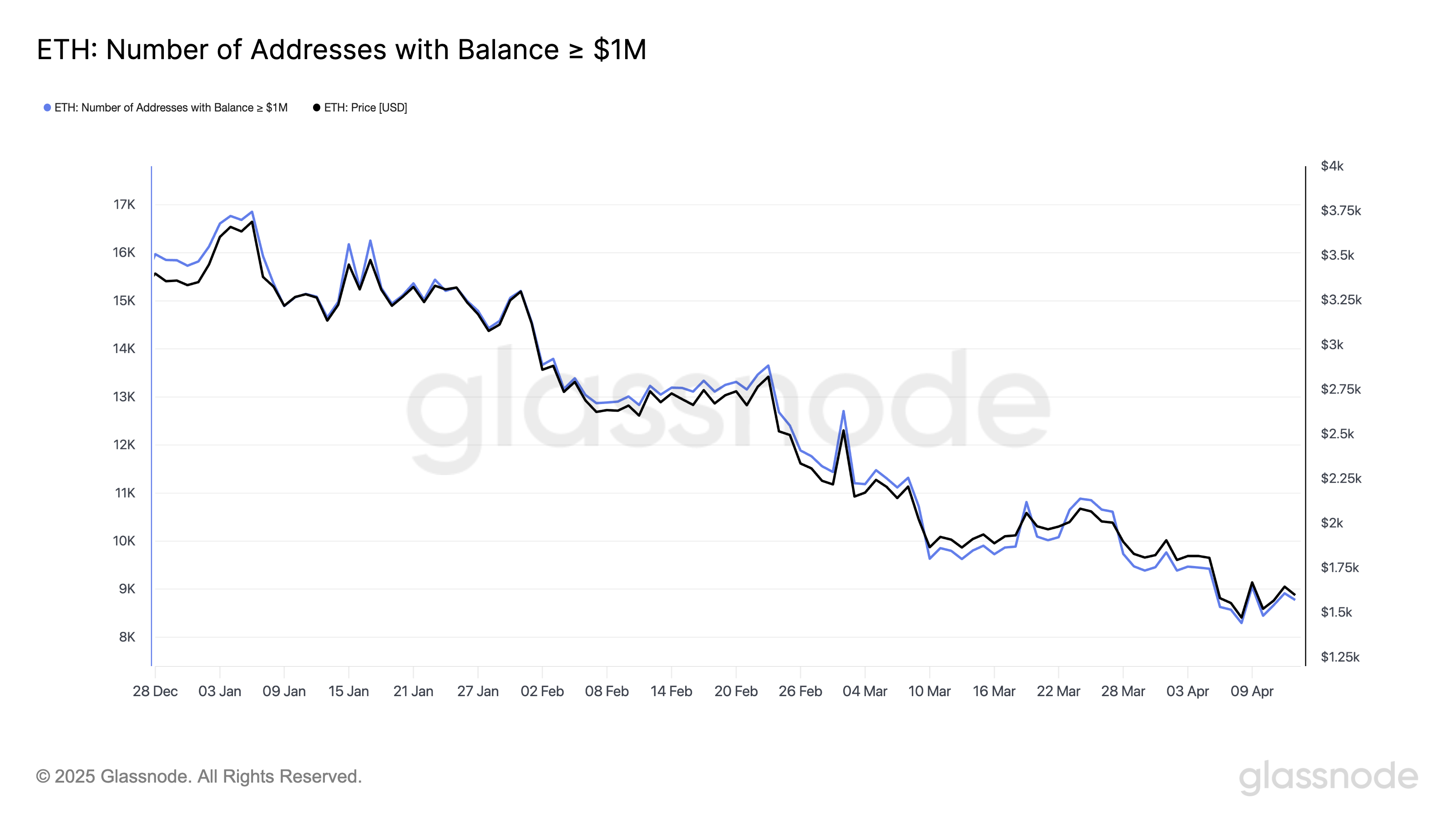

Nonetheless, overwhelming efficiency has thwarted traders. GlassNode knowledge reveals that the variety of addresses holding ETH at the very least $1 million has been declining sharply for the reason that starting of the yr (YTD). Final week, these addresses fell to lows not seen since January 2023.

Holders with at the very least $1 million value of ETH. Supply: GlassNode

A better have a look at the newest whale exercise confirmed the decline. On April 14, the whales deposited 20,000 ETH, value $32.4 million, with Kraken Alternate, presumably making ready for extra gross sales.

“The whales nonetheless have 30,874 ETH ($50.7 million) remaining, with an estimated gross revenue of $104 million (+52.4%),” mentioned Chain on Chain.

Moreover, on-chain analysts revealed that ICO traders in early 2015 have been persistently promoting. On April 13, the whales offloaded the 632 ETH, value about $10 million.

For the reason that starting of April, the investor has bought 4,812 ETH, value round $800,000. Surprisingly, the preliminary funding value was as little as $0.3 per ETH, and the whales nonetheless owned a substantial stash of 30,189 ETH.

Moreover, one other dormant ETH whale that has been inactive for years has additionally begun on sale. This deal with retracted 3,019 ETH from HTX between August and December 2020. The traders then moved their belongings to their present gross sales deal with three years in the past.

On April 11, the whales made their first deposit of 1,000 ETH to Binance. On April 13, the whales deposited a further 1,000 ETH, elevating considerations a few potential sale.

“Luckily, the whales solely have 1,018 ETH remaining, so we do not put a lot gross sales strain in the marketplace,” analysts mentioned.

The current rise of dormant whales is noteworthy. Their sale nonetheless advantages, however their actions recommend that they purpose to keep up this development. In line with GlassNode, solely 36.1% of Ethereum addresses, that are at present helpful, are worthwhile, indicating that almost all of householders face losses.

Ethereum holder of revenue. Supply: GlassNode

In the meantime, the present state of affairs at Ethereum has led analysts to attract comparisons to the decline brought on by Nokia’s domination within the late 2000s. As reported by Beincrypto, analysts warned that extra scalable and sooner platforms like Solana (Sol) may take over, and Ethereum may head in direction of a decline.

Nonetheless, pessimism has not unfold. Many analysts nonetheless predict the potential for restoration, citing upcoming expertise upgrades and market underestimation of ETH.