Key takeaways

- Whereas some bank card issuers will routinely enhance your credit score restrict over time for those who qualify, you may also request the next restrict.

- Capital One helps you to request the next credit score restrict via your on-line account administration web page, or you possibly can name in to inquire.

- It’s simpler to qualify for the next credit score restrict on a Capital One card if in case you have a historical past of utilizing your card responsibly, your revenue has elevated or you have got different causes to assume you’ll be eligible for extra out there credit score.

The next credit score restrict may offer you extra flexibility in your price range and profit your credit score rating by lowering your credit score utilization ratio. That is true in relation to Capital One bank cards, in addition to playing cards from different issuers, though particular person firms all have their very own processes in relation to granting extra out there credit score.

In case you have a Capital One card particularly, requesting the next credit score line needs to be a breeze. Right here’s what you should learn about rising your credit score restrict with Capital One, both by displaying your creditworthiness so your restrict is elevated routinely or by taking the initiative to request extra credit score as an alternative.

Earlier than you apply for a credit score enhance

Earlier than you apply for the next credit score line with Capital One, you’ll wish to take into consideration your present credit score restrict and the way you’re utilizing it, together with how a lot credit score you wish to have. You must also take into account your present monetary standing and the way possible you’re to get accredited for extra credit score for those who request it.

Inquiries to ask your self embody:

What’s your present credit score restrict?

Earlier than you resolve how large of a rise to ask for, be sure you know the present restrict in your Capital One bank card. You may simply discover this info by logging into your account.

EXPAND

Happily, asking for a credit score restrict enhance with Capital One gained’t negatively affect your credit score rating. It is because the cardboard issuer solely performs a delicate inquiry for credit score restrict enhance requests, and delicate credit score inquiries don’t affect your credit score in any approach.

How a lot credit score would you like?

Whereas it could possibly be tempting to ask Capital One to double the quantity of accessible credit score you have got proper now, asking for 10 p.c to twenty p.c extra credit score could also be extra affordable and current the next likelihood the request shall be accepted.

Additionally, take into consideration how your card issuer decided your authentic credit score restrict. Contemplating what components have modified in your credit score report may give you an thought of what you could be accredited for now.

Are you eligible for a rise?

Capital One evaluates numerous standards when figuring out whether or not to grant a credit score restrict enhance. Listed here are a number of components that may make it easier to get accredited:

- You’ve been utilizing your Capital One card responsibly. A optimistic fee historical past demonstrates which you can handle debt effectively, so the issuer is likely to be extra inclined to increase extra credit score to you.

- You’ve had your Capital One account open for a number of months at a minimal. The longer you’ve had your card, the extra time you’ve needed to present the issuer you’re a accountable borrower.

- It’s been a number of months or longer since your final credit score restrict enhance. If you happen to ask for extra credit score too usually, the issuer would possibly interpret it as a pink flag signaling that you just is likely to be in dire want of money.

- You will have an unsecured Capital One bank card. Capital One doesn’t grant larger credit score limits on its secured bank cards except you enhance the quantity of your safety deposit.

3 ways to extend your credit score restrict with Capital One

There are a number of methods you will get a credit score restrict enhance with Capital One — and typically you don’t even should ask.

1. Obtain an computerized credit score restrict enhance

Capital One could routinely enhance your credit score restrict for those who use your bank card responsibly. Some Capital One playing cards, particularly these geared towards customers establishing or constructing credit score, supply the chance for a rise after six months of on-time funds.

2. Request a credit score restrict enhance on-line

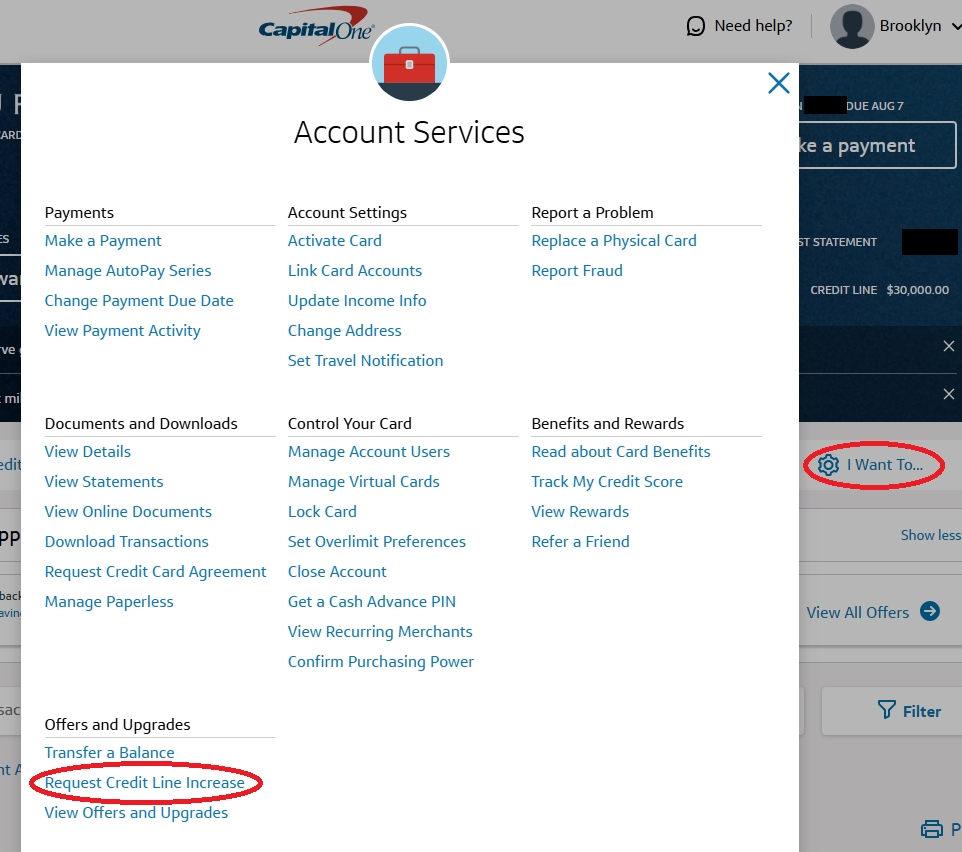

The simplest strategy to ask for the next credit score line is thru your on-line account. Log in to your account in an online browser and click on “Request Credit score Line Improve” within the “I wish to” part of settings. You are able to do this on the internet model of the Capital One web site or within the Capital One cell app by way of your profile web page.

EXPAND

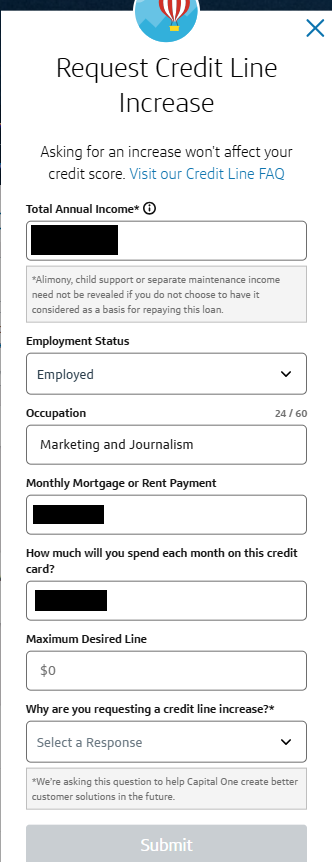

This can deliver you to a different web page the place you possibly can replace your revenue info (beneficial in case your revenue has elevated), ask for the next credit score restrict or set overlimit preferences.

EXPAND

3. Name Capital One customer support

Another choice is to name the quantity on the again of your card. Be ready to reply some questions and have all of the required info useful. You would possibly want to elucidate why you’re requesting extra credit score, so consider that upfront. Has your revenue elevated? Are you planning a big buy? What warrants the next credit score line in your scenario?

This may occasionally appear to be a trouble in comparison with making the request on-line, however speaking to a consultant presents a possibility to personally current your case for the credit score restrict enhance. Point out your optimistic fee historical past and the way lengthy you’ve been a cardholder to enhance your approval odds.

How lengthy does a credit score line enhance take?

If you happen to’re requesting the rise on-line, your credit score restrict enhance could also be accredited instantly after you present some info, comparable to your employment standing and annual revenue. In different instances, it’d take a number of days to get a response from the issuer.

Equally, for those who name to request a rise, a Capital One consultant would possibly provide the determination immediately or take a number of days to assessment your account.

What to do in case your request is denied

Requesting the next credit score line is an easy course of with Capital One, however approval isn’t assured. If you happen to’ve been denied, don’t fear. There are various options and steps you possibly can take to enhance your possibilities the following time you inquire.

Work in your credit score

Pay down debt, make on-time funds and use your bank cards responsibly. The next credit score rating and clear credit score report improves your odds of getting extra out there credit score, whether or not you’re looking for extra credit score in your current playing cards or making use of for a brand new one.

Apply for a unique bank card

Talking of latest bank cards, making use of for a unique supply may also result in having access to extra credit score. If Capital One denied your credit score restrict enhance request, it’d make sense to use for a bank card from a unique issuer.

In case your credit score rating isn’t in the most effective form, look into bank cards for poor credit or bank cards for honest credit score to keep away from one other denial. To these with good or wonderful credit score, one other bank card can supply extra buying energy in addition to an opportunity to proceed bettering credit score.

Attempt a steadiness switch

In case you are contemplating a credit score restrict enhance since you’ve gotten too near the credit score restrict in your card, you would possibly wish to look right into a steadiness switch.

With a steadiness switch bank card, you possibly can switch balances from current playing cards and never pay something in curiosity for a number of months. One of the best 0 p.c APR bank cards supply zero curiosity for 21 months, so be sure that to match your choices.

Take into account prequalification choices

A bank card utility will set off a tough inquiry that may knock a number of factors off your credit score rating. To see for those who prequalify with out affecting your credit score rating, take a look at Bankrate’s CardMatch function which makes use of a delicate pull to match you with a card that most closely fits your wants.

The underside line

Quite a few advantages can come up from rising your credit score restrict. You might be able to enhance your credit score utilization ratio, enhance your credit score rating, enhance your probabilities of being accredited for different prime bank cards down the highway and extra.

To make the most of these advantages, be sure you are dealing with your debt responsibly so your card issuer will wish to offer you entry to extra credit score. Even when Capital One rejects your request, you possibly can take steps to extend your possibilities for subsequent time and check out once more in a number of months.