Causes to belief

Strict modifying coverage specializing in accuracy, relevance and equity

Created by business consultants and meticulously reviewed

The very best normal for reporting and publishing

Strict modifying coverage specializing in accuracy, relevance and equity

The soccer value for the Lion and Participant is mushy. I hate every of my arcu lorem, ultricy children, or ullamcorper soccer.

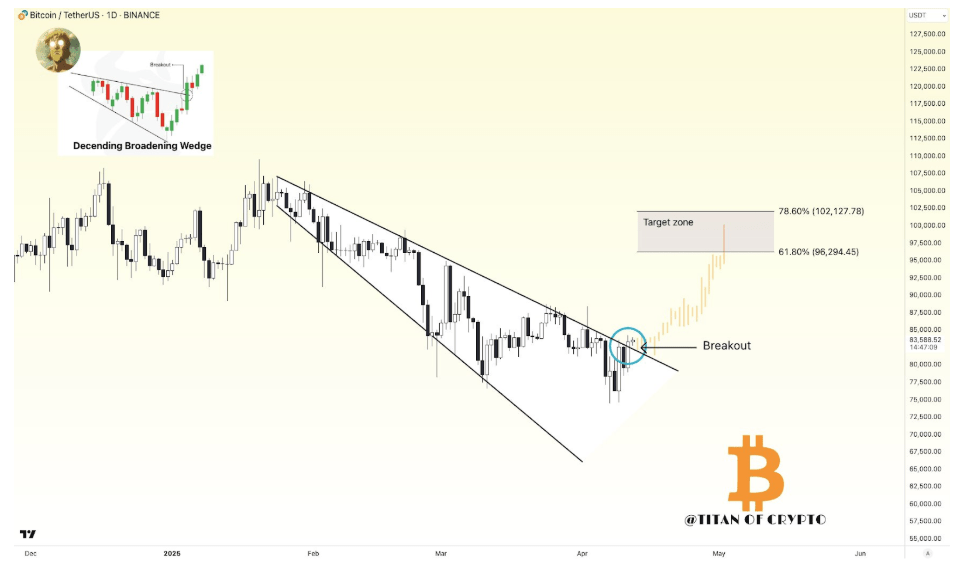

Bitcoin is cut up from a technical formation that may get you on observe in the direction of a essential take a look at zone of between $96,200 and $102,100. If confirmed within the subsequent few days, this motion represents a serious value improvement of Bitcoin’s steady market construction. Crypto analysts highlighted this zone as a potential extension of Bitcoin’s trajectory to a brand new excessive or face the subsequent rejection.

Associated readings

Descending Wedge Breakout clears the cross once more to $100,000

Bitcoin value motion during the last 24 hours has been highlighted by returning to $85,000 when buying stress started creeping up. Apparently, this buy stress erupted above the highest trendline of an enormous, downward wedge formation. This sample is often thought-about an inverted sign, and its breakout, when verified, means a robust upward continuation.

Formation breakouts have been permitted Evaluation posted above Social Media Platform X by Crypto Analyst Titan of Crypto. Specifically, the value listing shared by analysts exhibits that wedge formations have been going down within the every day candlestick timeframe over the previous three months. After Bitcoin peaked over $108,000 in late January and regularly expanded, the wedge started to kind.

On the time of research, the value of Bitcoin It was already made Two every day candlesticks are closed above the highest pattern line of the spreading wedge. Analysts say the breakout is prone to be confirmed this week. If confirmed, this once more opens a operating stage that exceeds the $100,000 value stage or at the very least over $96,200.

Specifically, Titan from Crypto highlighted the $96,200-$102,100 area as its subsequent goal zone. Analysts highlighted that this vary may function an actual take a look at of Bitcoin’s energy. That is to make clear whether or not breakouts result in continuance or rejection.

picture From X: Titan The code

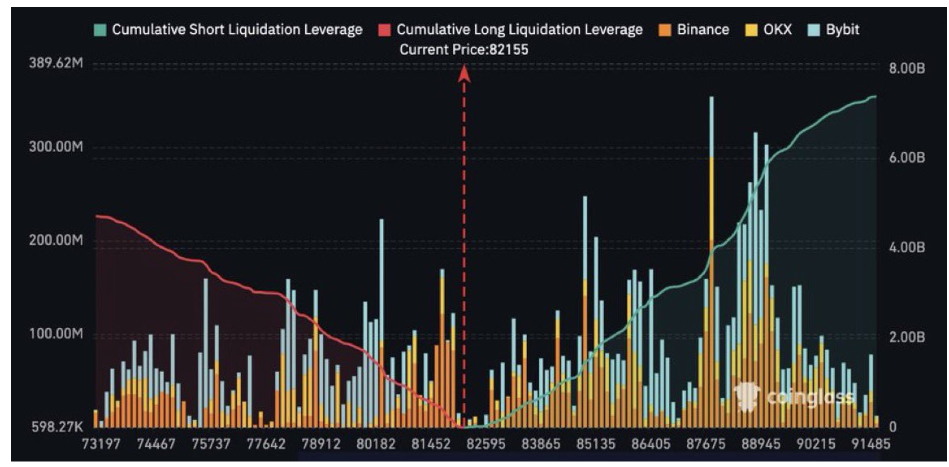

Construct-up factors benefit from the potential for a brief aperture of $8 billion, over $90,000

Crypto Analyst Sensei I’ve commented once more Bitcoin’s present value construction notes {that a} transfer to $90,000 may set off an enormous liquidation occasion. Primarily based on Coinglass information, Bitcoin’s quick positions of over $8 billion grow to be weak It once more rose above $90,000.

Coinglass’ cumulative quick liquidation charts illustrate a serious barrier of leveraged quick curiosity, concentrated beneath that stage throughout main exchanges resembling Binance, OKX, Bybit.

picture From X: Trainer

Associated readings

The info displays a serious imbalance within the derivatives market, with dominant positions as much as the $90,000 mark, past which liquidation-driven purchases may intensify. If Bitcoin is pushed into this zone, the ensuing cascade of liquidation between quick positions may present the momentum wanted to push Bitcoin’s value from $96,200 to the $102,100 goal zone.

On the time of writing, Bitcoin was buying and selling at $84,706.

Freepik featured photos, TradingView charts