The NFT market is feeling the affect of a wider cryptocurrency drop, with gross sales quantity falling 4.7% to $94.7 million.

This can be a persevering with downward pattern of $102.8 million final week, in response to Cryptoslam knowledge. Drops prolong past gross sales quantity alone, with NFT patrons growing by 77.9% to 128,244, and NFT sellers lowering by 75.2% to 85,792. NFT transactions additionally fell by 6.3% to 1,441,009.

The downward momentum coincides with Bitcoin (BTC) dropping to a stage of $83,000. On the similar time, Ethereum (ETH) has misplaced 13.5% of its worth within the final seven days, hovering on the $1,500 stage.

The worldwide crypto market capitalization is presently at $2.63 trillion.

You would possibly prefer it too: Following the bullish bulge, the attention stage of the Sonic Token

Regardless of the worth drop, Ethereum stays dominant

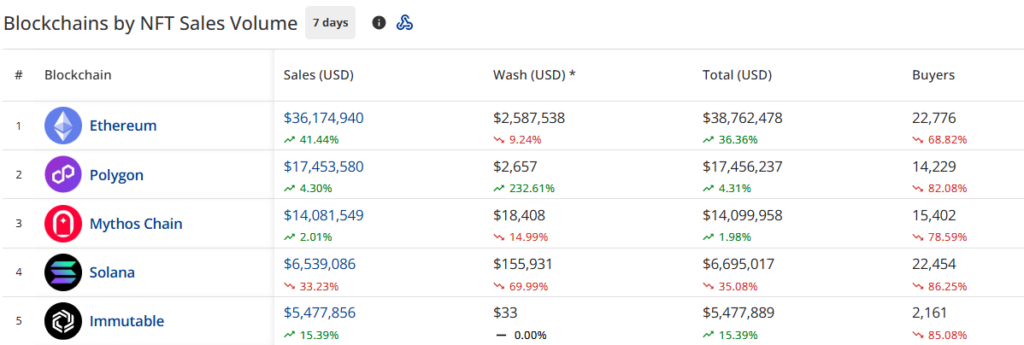

The Ethereum blockchain stays the dominant participant with gross sales of $36.1 million, up 41.3% from final week. Nonetheless, this increase in Ethereum gross sales was not enough to offset the decline amongst different chains.

Polygon (Pol) was second out there, with gross sales quantity of $17.4 million, displaying a modest enhance of 4.3%. The Mythos chain ranked third at $14.1 million, a mere 2% enhance.

Solana (Sol) continues to wrestle as gross sales fell sharply by 33.4% to $6.5 million. The Unchanging marks the highest 5 with a gross sales of $5.5 million, up 15.4% from the earlier week.

Supply: Blockchain based mostly on NFT gross sales quantity (Cryptoslam)

You would possibly prefer it too: Excessive lipids present bullish reversal, with key targets seen at $18.50

Polygon is presently main at $2.6 million, which has modified the washing buying and selling sample. This can be a noticeable 232.6% enhance. Ethereum’s washing transaction additionally fell 9.2% to $2.5 million.

Relating to the highest NFT assortment, Polygon Courtyard stays at its highest place with gross sales of $15.6 million and a 6.1% enhance. Cryptopunks rose to second place with a surge of $9.1 million, a 168.3% enhance.

DMARKET is presently third at $8.9 million, up 4.4%. Newcomer F(X)WSTETH’s Ethereum place was ranked fourth with gross sales of $5.8 million.

Guild of Guardian Heroes will full the highest 5 with gross sales of $3.7 million, up 29.4% from the earlier week.

This week we noticed excessive worth gross sales at Cryptopunks #3100, which sells for 4,000 ETH ($6,042,922). Different notable excessive worth gross sales embrace:

- Cryptopunks #1182 is on the market for 142 ETH ($209,310)

- Pixel Vault Founders DAO #4 bought for 97.08 res ($161,511)

- Autoglyph #462 bought for 98.5 Wes ($149,724)

- Cryptopunks #5361 is on the market at 69.69 ETH ($108,204)

opensea to sec: “We’re not a change”

This week, Opensea requested the U.S. Securities and Alternate Fee (SEC) to formally declare that NFTs are usually not “exchanges or brokers” below the U.S. Securities Act.

In a letter to SEC Commissioner Hester Perth, Opensea argued that NFTS often solely have one vendor per token. Because of this, platforms like theirs do not perform like conventional inventory exchanges or brokers.

They emphasised that each one NFT transactions happen on-chain through sensible contracts. Opensea acts merely as a discovery software, not only a middle-way, custodian, or recommendation giver.

To keep away from future disruption, Opensea is asking the SEC to concern clear steering resembling breaking information and interpretation releases to make sure that the NFT market is just not coated by change guidelines.

This push follows Opensy’s brush with Wells’ notification final 12 months. Nonetheless, the SEC stopped investigating in early 2025 after President Donald Trump instructed the company to droop code enforcement.

learn extra: Uniswap’s 2025 forecast tank raises $600,000 in three days by Cartelfi