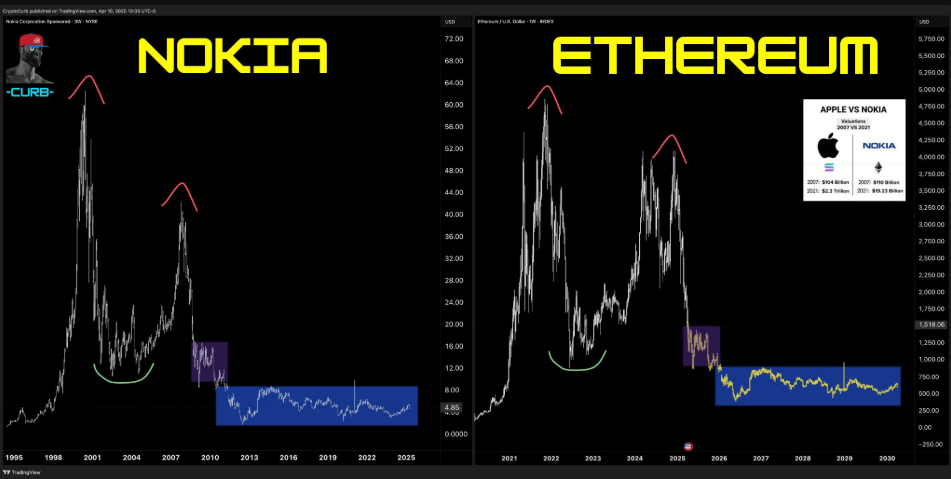

Analysts have derived a provocative comparability between Ethereum and Nokia, the as soon as dominant tech platforms that would not adapt rapidly sufficient to a aggressive market.

This comparability comes within the ongoing Ethereum vs. Solana debate. It goes again a few years and displays the deeper rigidity between legacy domination and next-generation efficiency. It issues which platforms are appropriate for being the spine of Web3, Defi, NFTS, and the broader crypto economic system.

Analysts examine Ethereum and Nokia

Analysts warn that, like Nokia, Ethereum may decline slowly, identical to the outdated cell phone makers that Apple overtaked within the late 2000s.

“Ethereum = Nokia,” writes analyst Crypto Curb.

Analysts shared two charts. Nokia’s inventory worth collapsed from its peak in 2007, and Ethereum’s market capitalization has fallen from its excessive in 2021.

Analysts examine Ethereum to Nokia. Supply: x’s code curb

The analogy is rooted in additional than only a market chart. Curb argues that Ethereum’s ageing structure and scalability limitations replicate the downfall of Nokia’s Symbian OS, which didn’t compete with Apple’s iOS and Google’s Android.

Statista knowledge exhibits that by 2013, Nokia’s cell market share had collapsed to three.1% from a peak of 49.4% in 2007.

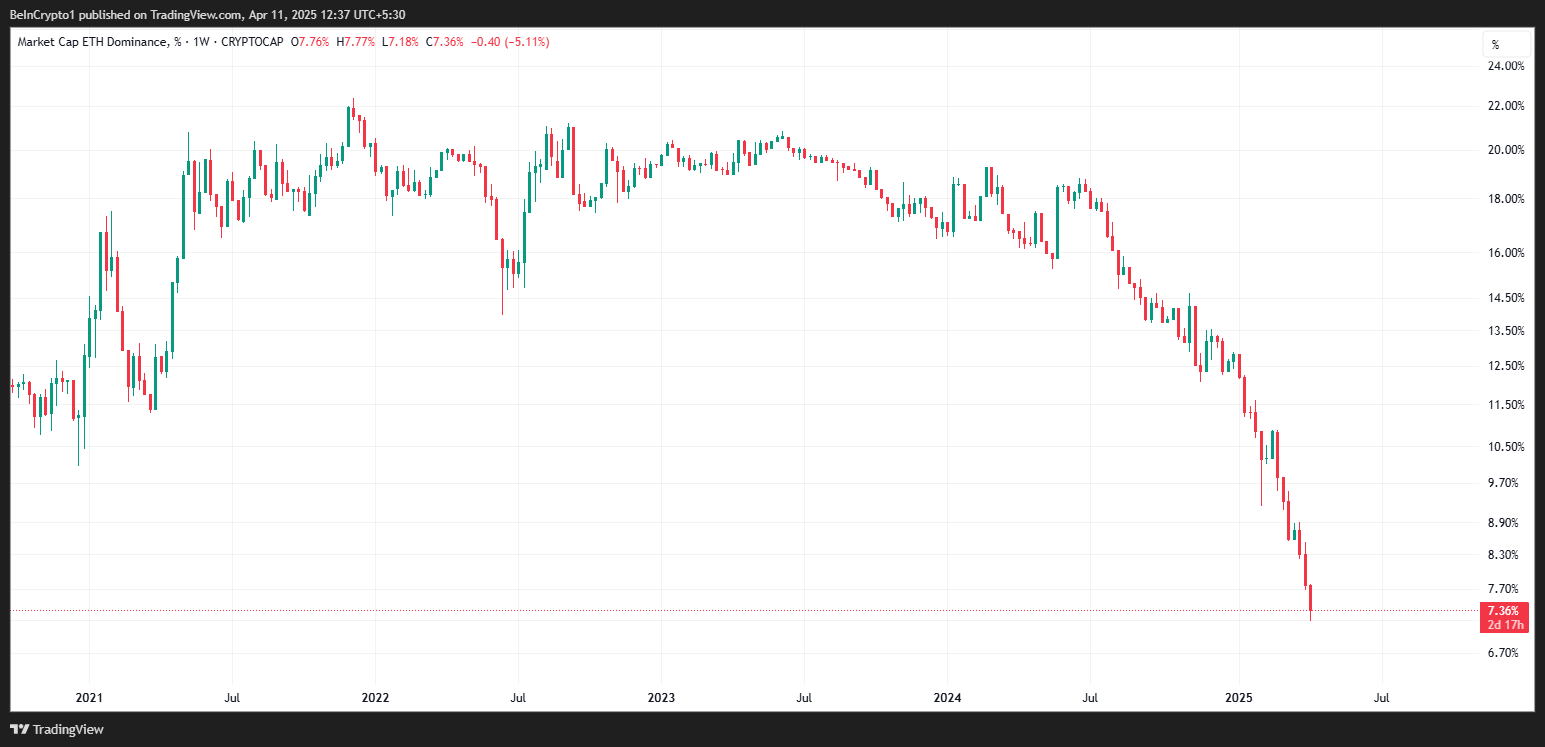

In the meantime, TradingView knowledge exhibits that Ethereum, which as soon as led greater than 20% of the market capitalization of the Qing Po, holds lower than 10% on the time of this writing.

Ethereum Dominance Chart. Supply: TradingView

This publish implies that, like Nokia, Ethereum could also be slowly dropping its connection amongst its quicker, extra scalable rivals, Solana amongst them.

Alternatively, Solana’s rise is tough to disregard. Between October 2023 and November 2024, Sol surged from $23 to $264, rising to almost a 3rd of Ethereum’s market capitalization.

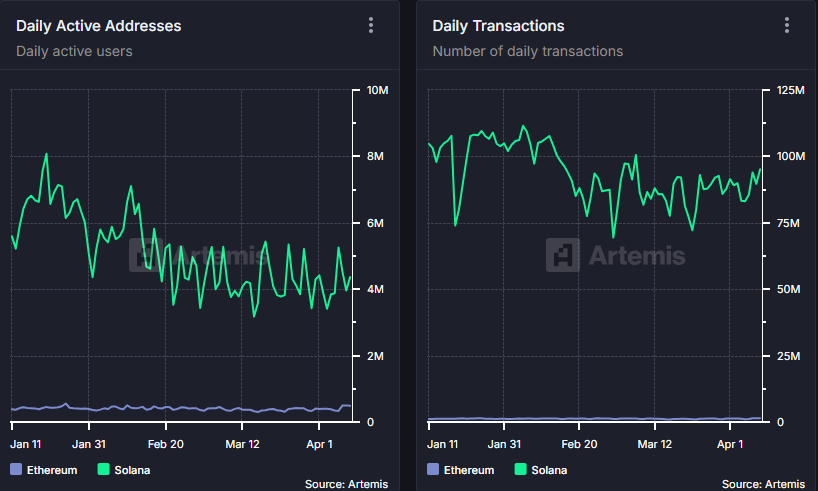

In response to on-chain knowledge, Solana is superior to Ethereum in some vital metrics. Amongst them are day by day lively addresses and day by day transactions, highlighting their attraction to builders and customers.

Solana vs Ethereum is present in day by day lively addresses and transaction metrics. Supply: Artemis knowledge

The similarities are strict. Apple jumped over Nokia with a smoother consumer interface and a developer-friendly ecosystem.

Equally, Solana’s technical benefits are positioned as a severe candidate for Ethereum’s dominance in Decentralized Finance (DEFI) and Web3, together with greater throughput, decreased charges and improved consumer expertise (UX).

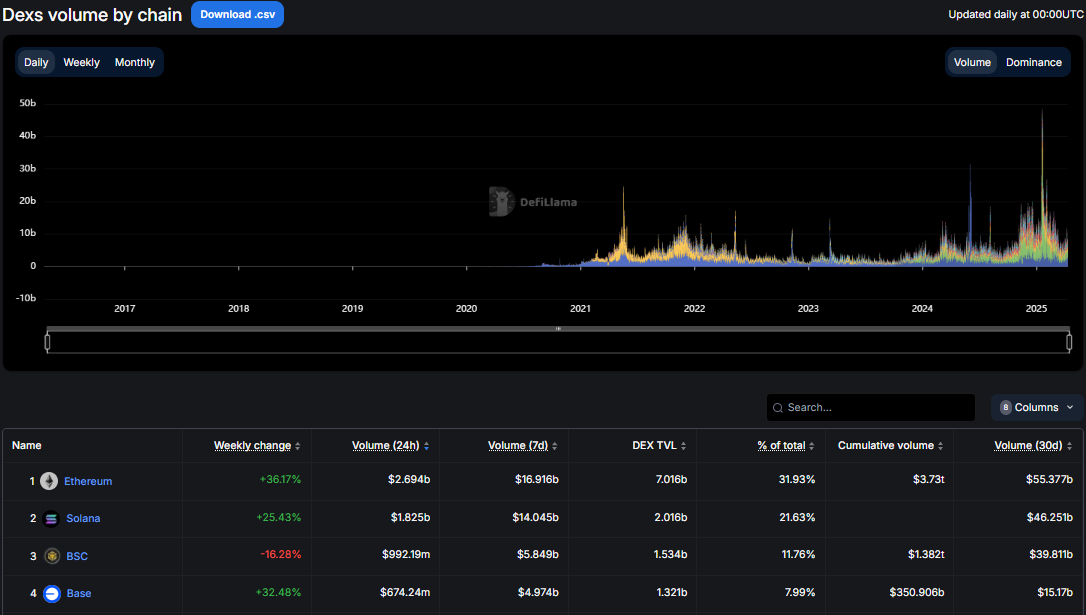

However not everybody is certain that Ethereum days are counted. Every week in the past, Ethereum overturned Solana with a decentralized alternate (DEX) buying and selling quantity.

Beincrypto reported this milestone, however this was the primary time in six months. Defilama’s knowledge exhibits that Ethereum continues to keep up this lead.

Transaction quantity per chain. Supply: Defilama

This revival on this buying and selling exercise means that Ethereum stays deeply embedded within the crypto ecosystem, significantly amongst refined Defi customers.

Moreover, some institutional voices stay cautiously bullish in Ethereum. In March, an analyst at Franklin Templeton stated Solana’s scarcity was spectacular and will problem Ethereum’s market worth, however ETH nonetheless retains key infrastructure advantages.

“Solana nonetheless has a protracted approach to go earlier than it surpasses Ethereum,” an analyst at Intotheblock instructed Beincrypto.

Equally, some analysts are contemplating the potential for a robust Ethereum worth rise, citing bullish foundations like Pectra upgrades and Aesthetics ETFs (Trade-Traded Funds).

Nonetheless, the comparability of Curb displays key moments in Ethereum’s progress. With rivals like Solana transferring forward in usability and efficiency, Ethereum must speed up its roadmap to make sure it is not hidden.

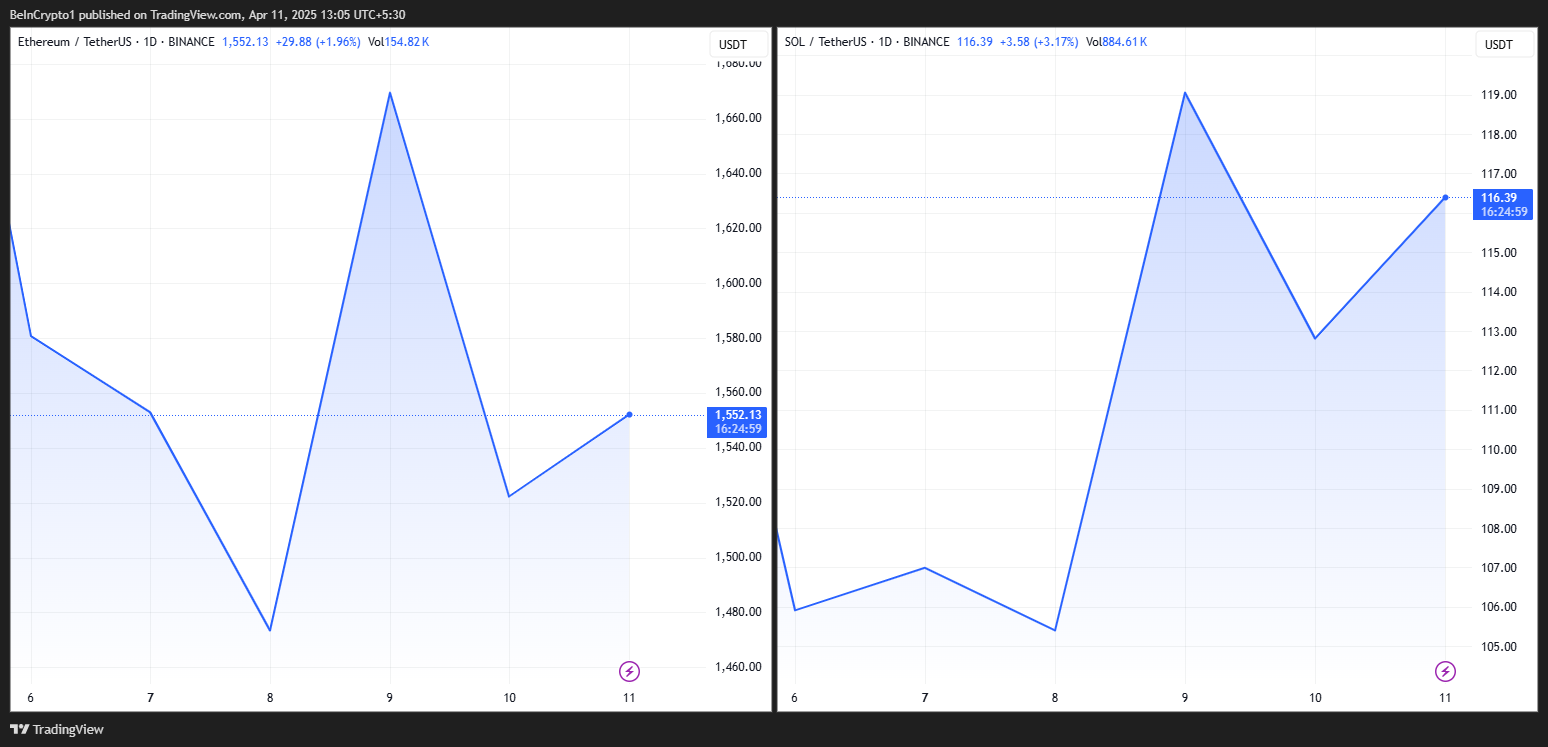

Ethereum and Sora Solana worth efficiency. Supply: TradingView

Information exhibits that ETH has traded at $1,552 on the time of writing, down greater than 4% over the previous 24 hours. In the meantime, Solana traded at $116.39, a modest 1.01% surge in in the future.