As Bitcoin’s valuation approaches its weakest level since final yr, with Hashpris, day by day revenues of petahash (pH/s) per second (pH/s) have retreated to $40, which has brought on the community’s computational muscle to paradoxically swell to a historic peak.

Bitcoin hashrate hits historic excessive amid costs plummeting

This stretch has confirmed tough for Bitcoin miners, with revenues being signed quickly. On April 2, in keeping with former President Donald Trump’s announcement of huge commerce tariffs, Hashpris hovered at $48.45 earlier than cascaded to $40 per PH/s.

With the pressure worsening, mining complexity metrics pushed 6.81% simply 4 days in the past at block 891,072, at an unparalleled problem of 121.51 trillion. Conventional logic means that such a triple (depreciation worth of BTC, lowered miners’ revenue, and elevated operational demand) erodes world computational output.

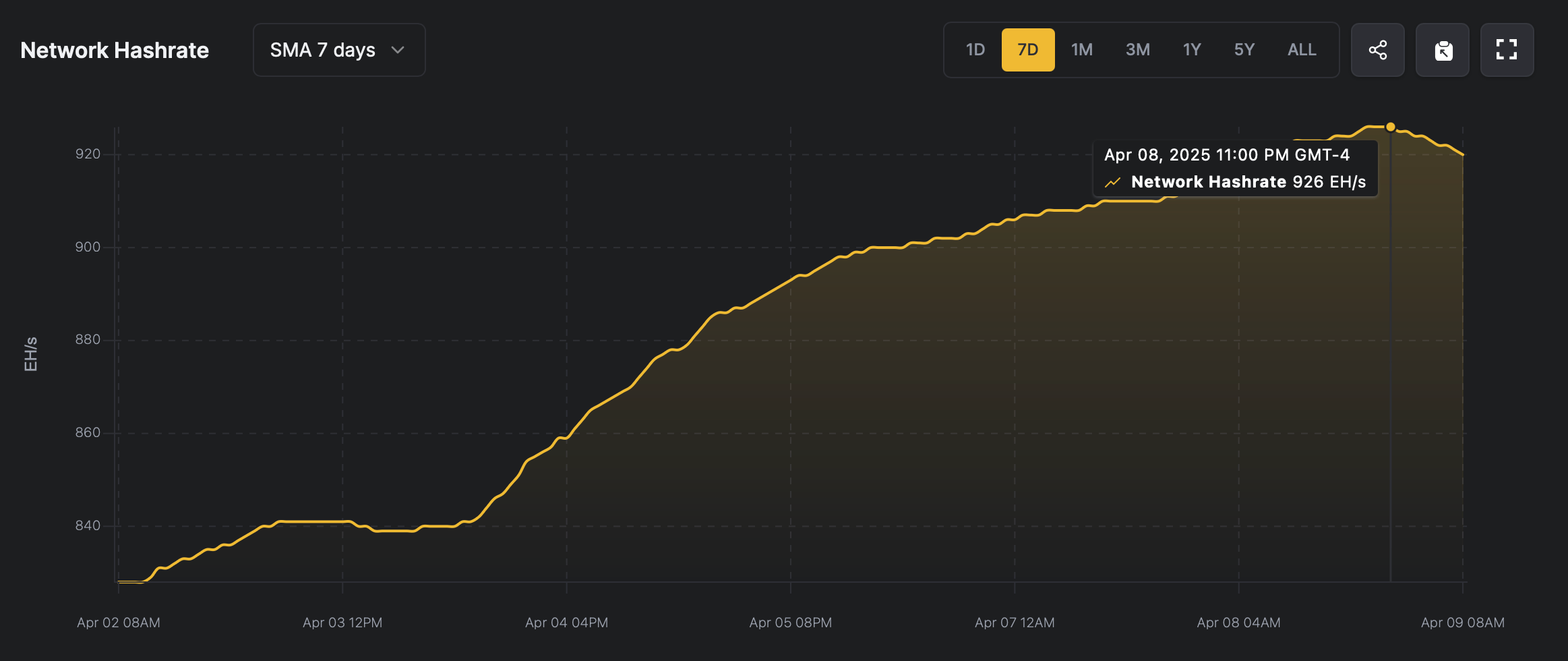

However reverse growth: Bitcoin hashrate ignored gravity and scaled to an unparalleled peak on Tuesday, April 8, 2025. Metrics quickly cheate at 926 Ekhash (EH/s) per second, inching inside 74 EH/s of the elusive 1 Zetahash (Zh/s) threshold.

By 9:30am on Wednesday, April ninth, it had eased barely to 921.06 EH/s and remained close to the stratospheric peak. The block interval displays the anticipated 10-minute commonplace, and though the readjustment of the approaching problem on April 19 seems to be slight, the volatility stays very cheap.

In the meantime, the lethargy of transactions past the Bitcoin blockchain has brought on unusual stretches of underutilized blocks and decrease price stress. At present, premium transactions command a modest 2 Satoshis per digital byte (SAT/VB).

Previously day, fee-derived revenues accounted for simply 1.32% of miners’ complete compensation, exposing ecosystem thinning revenue margins. Nevertheless, within the illustration of the algorithm’s revolt, community calculations can persist in stratospheric peak scaling.