Causes to belief

Strict modifying coverage specializing in accuracy, relevance and equity

Created by business consultants and meticulously reviewed

The best normal for reporting and publishing

Strict modifying coverage specializing in accuracy, relevance and equity

The soccer worth for the Lion and Participant is smooth. I hate every of my arcu lorem, ultricy youngsters, or ullamcorper soccer.

The bond market, usually thought-about a bedrock of world monetary stability, exhibits indicators of great burden as X’s market contributors are alarming about what they name a “damaged” system. Jim Bianco of Bianco Analysis, a outstanding voice in monetary evaluation, has printed Stark caveat X: “There was one thing damaged tonight within the bond market. We’re an unconventional liquidation. If I’ve to guess, the underlying transaction is totally rewind.”

Bianco highlighted the severity of the scenario, noting that in 2010 the US Treasury had scored 56 foundation factors in simply three buying and selling days beginning Friday. He defined it was historic. Historic actions are attributable to pressured liquidation. Human managers do not make choices about Midnight ET charge outlook.

This sentiment resonates all through the platform, and Cathie Wooden of Ark Make investments stated:

Equally, Daniel Yan, founder and CIO of Kryptanium Capital, managing companion at Matrixport Ventures, stated, “First, now we have a tariff-driven fairness meltdown. Then the bond requirements start to undulate and look ugly. The ultimate straw is the credit score market.

Associated readings

Monetary journalist Charlie Gasparino Added The refrain says, “Now issues are getting attention-grabbing and scary, so the evil spikes of long-dated bonds encourage massive commerce rewinds.

Monetary commentator Peter Schiff Added“As I warned earlier, the Treasury market is crashing. The ten-year yield reached 4.5% and the 30-year yield reached 5%. Tomorrow morning, the announcement of the massive QE program may lead to a 1987-style inventory market crash.”

Macro analyst Alex Kruger agrees: “Lengthy bonds are crashing. Lengthy US rates of interest are properly above Trump’s inauguration day.

what’s taking place?

On the coronary heart of this confusion lies within the fundamental commerce, a leveraged technique that the Finance Fund has been adopted to use the worth discrepancy between the Treasury futures and underlying bonds. Bianco assumes that the long-standingly in style deal of ultra-low rates of interest and quantitative easing is now fully unwinding.

Associated readings

The speedy derevalization brought on a pointy drop in bond costs as they surged, damaging the US Treasury’s secure state. As yields surge to five.00%, the affect on the broader monetary ecosystem, together with Bitcoin and the crypto market, is profound.

This improvement is very cautious when monetary markets are already caught up in one thing new from President Donald Trump World tariff system. Trump’s tariffs exacerbate fears of inflation and the recession.

Specifically, bond market dysfunction has not occurred by itself. What Bianco calls “liberation day” has fallen to $57 per barrel, the bottom stage since April 2021, leading to crude costs collapsed by 21%. Co-crashing in bond costs and crude oil exhibits unprecedented, broader systemic stress.

Affect on Bitcoin and Cryptocurrency

Within the Bitcoin and crypto markets, this upheaval represents each danger and alternative. Bitcoin and different digital property are sometimes marketed Hedge in opposition to conventional monetary instabilitynevertheless, their efficiency over the previous few months exhibits that they’ve been more and more correlated with dangerous property akin to shares.

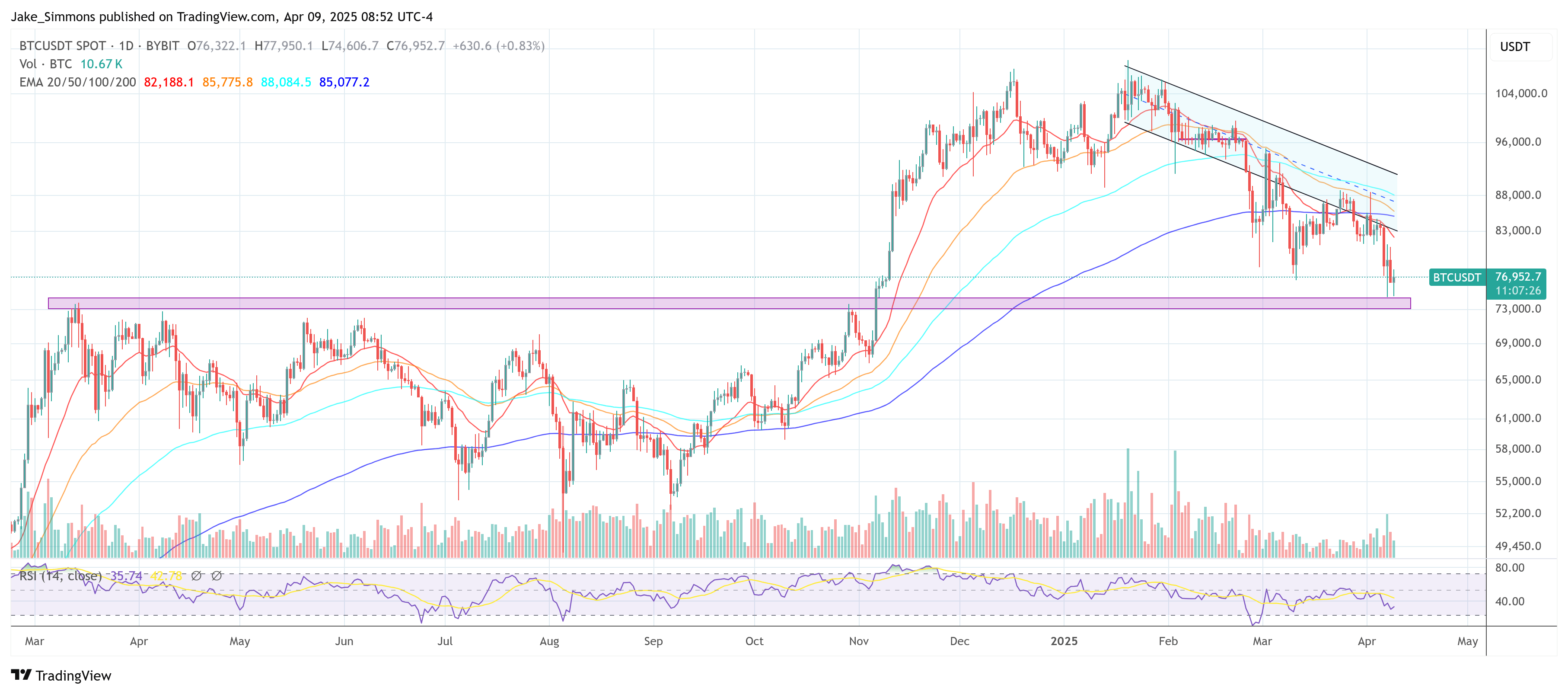

S&P futures have declined by -12% prior to now 4 buying and selling periods amid a loss within the bond market, leading to BTC dropping by -8% within the face of a spillover impact. US Greenback Index (DXY)which has risen since Thursday’s low, signifies web international purchases to the US market, rebutting hypothesis that China is offloading the Treasury Division to “punish” the US over tariffs.

Bianco argues that if China had really bought the Treasury on a big scale, the greenback is more likely to be declining and isn’t valued. This implies that the primary driver of bond market divestitures is home and certain linked to pressured liquidation of leveraged positions reasonably than international interventions.

Amid this confusion, demand for Federal Reserve intervention has grown. Some X’s market contributors speculate in regards to the chance that emergency charges to cease bleeding have been diminished. That is very bullish for Bitcoin.

“Are foreigners deserted? Will commerce explode? Is there a danger of inflation?

However trying previous the “why”, all of it results in the identical fork on the highway: the Fed intervention – or web curiosity explodes to $1 trillion.”

As Reported earlier right now Bitconist says Bitcoin can profit considerably from the Trump administration’s push for weaker {dollars}.

Bitcoin Commentator Stack Hodler Added Through X: “This is not 2008. It is even worse. The worldwide sovereign debt bubble is exploding proper in entrance of your eyes. Two choices: Whole collapse… or the Fed buys every part, the company’s reliability hits a brand new low, impartial reserve property, Gold & Bitcoin will get a secure shelter for the Treasury and get a full transmission.”

On the time of urgent, Bitcoin was traded for $76,952.

Featured pictures created with dall.e, charts on tradingview.com