Causes to belief

Strict modifying coverage specializing in accuracy, relevance and equity

Created by business consultants and meticulously reviewed

The best customary for reporting and publishing

Strict modifying coverage specializing in accuracy, relevance and equity

The soccer worth for the Lion and Participant is smooth. I hate every of my arcu lorem, ultricy youngsters, or ullamcorper soccer.

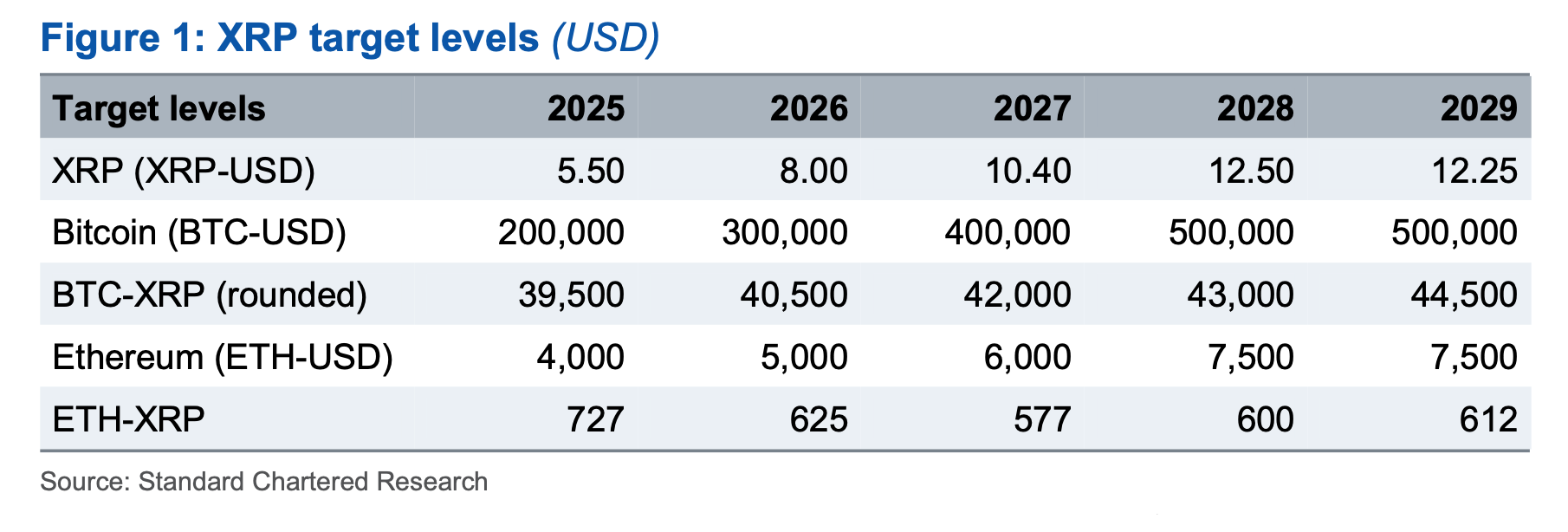

Customary Chartered Analysis has launched a daring forecast to put XRP on its market capitalization within the subsequent 5 years, highlighting what’s described as a multi-year worth rally for tokens. The forecasts shared by Geoffrey Kendrick, international head of digital asset analysis at Customary Chartered, map annual goal ranges for XRP, Bitcoin and Ethereum till 2029. It additionally reveals a key set of ratios that measure the relative energy of XRP in comparison with extra established friends.

XRP, BTC and ETH worth forecasts

In 2025, XRP is anticipated to achieve $5.50, whereas Bitcoin is projected to surge to $200,000 and Ethereum to $4,000. This ends in a BTC-XRP ratio of about 39,500 based mostly on the variety of tokens equal to at least one Bitcoin. Ethereum is valued at about 727 instances the worth of the XRP in the identical yr.

Shifting to 2026, XRP’s targets are projected to leap to $8.00, up virtually 45%, with Bitcoin projected to rise to $300,000 and $5,000 to Ethereum. The BTC-XRP and ETH-XRP ratios have risen and fall barely, respectively, suggesting that Bitcoin continues to outperform XRP in relative phrases, however XRP is predicated on Ethereum.

Associated readings

By 2027, XRP is anticipated to commerce for $10.40, Bitcoin is $400,000, and Ethereum is $6,000. The XRP worth will virtually double from the 2025 degree, however the BTC-XRP and ETH-XRP ratios (42,000 and 577, respectively) affirm the tighter hole with Ethereum, the place XRP reveals stronger relative efficiency, notably.

In 2028, XRP peaked at $12.50 on this forecast. Bitcoin reaches $500,000 And Ethereum continues its linear rise to $7,500. Regardless of the rise, XRP lags behind Bitcoin-proportional earnings, with a BTC-XRP ratio of as much as 43,000. Nevertheless, the ETH-XRP ratio strikes barely larger, indicating that Ethereum begins to regain some proof towards XRP.

Curiously, by 2029, Kendrick is forecasting a slight decline in XRP to $12.25. In the meantime, customary chartered analysts predict that Bitcoin will stay flat at $500,000, whereas Ethereum is secure at $7,500. Notably, the ETH-XRP ratio elevated barely to 612 and the BTC-XRP elevated to 44,500, reflecting slight erosion of the relative energy of XRP on the last stretch.

Nonetheless, in comparison with 2025, XRP ends a stronger forecast interval in phrases relative to Ethereum, as proven by the ETH-XRP ratio, which drops from 727 to 612.

XRP flips Ethereum

Kendrick’s prediction that it overtook Ethereum within the whole market capitalization of XRP is likely one of the report’s most notable claims. “By the top of 2028, we will see XRP’s market capitalization surpassing Ethereum,” he mentioned. message On the block.

Kendrick attributes this upward trajectory to the confluence of things, together with regulatory improvement, elevated institutional adoption, and widespread tokenization use instances. He particularly cites Ripple CEO Brad Garlinghouse’s announcement that the Securities and Alternate Fee has dropped its enchantment in a long-term lawsuit.

In accordance with Kendrick, the end result was anticipated within the aftermath of Donald Trump’s administration’s code-friendly stance. He says it paved the best way for a extra advantageous regulatory surroundings. He additionally hopes that the SEC will approve the XRP Spot ETF by the third quarter of 2025, with a possible influx of as much as $8 billion within the first yr of the checklist.

Associated readings

Kendrick argues that the basic utility of tokens in borders and forex funds is per one of many quickest rising use instances within the digital property sector. He observes that if the quantity of Stablecoin transactions is rising by round 50% every year and that progress is mirrored in XRP, token costs might rise steadily over the following few years.

In parallel, Ripple is deeply shifting in the direction of tokenization efforts, together with creating a tokenized US Treasury invoice fund and creating Stablecoin and RLUSD, a singular USD-backed Stablecoin that Kendrick believes might additional strengthen XRP’s place. “The XRP ledger, the blockchain for XRP, is a fee chain and will turn out to be a tokenized chain,” he mentioned.

Regardless of these promising indicators, Kendrick acknowledges that the developer ecosystem stays comparatively small in comparison with Ethereum and different main blockchain ecosystems, which might problem widespread adoption. Moreover, the low-waste construction of tokens is a pretty function of funds, however might restrict the flexibility to seize further worth from community use.

Specifically, Kendrick has lately launched an optimistic model. Notes on Avalanche’s native token Avaxwe will predict that it might surge to $250 by 2029. Nevertheless, his prospects for Ethereum are much less enthusiastic. He lately Diminished ether worth goal for 2025 At 60% to $4,000, they describe ether as “recognized losers” and defend Bitcoin and Avax as “recognized winners.”

On the time of press, the XRP traded for $1.807.

Featured pictures created with dall.e, charts on tradingview.com