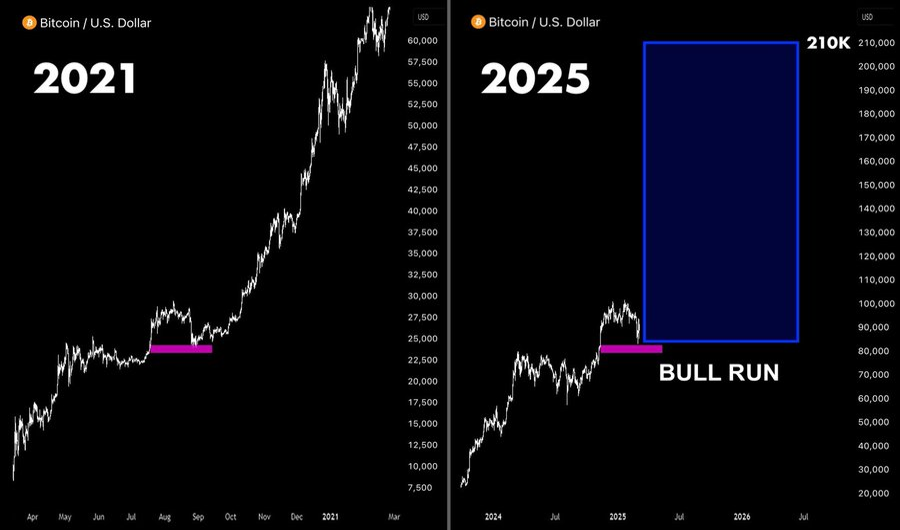

- Bitcoin mimics the 2021 setup, with $30,000 in help informing bullish base.

- The analyst chart reveals a repetitive cycle section suggesting a $210,000 breakout go.

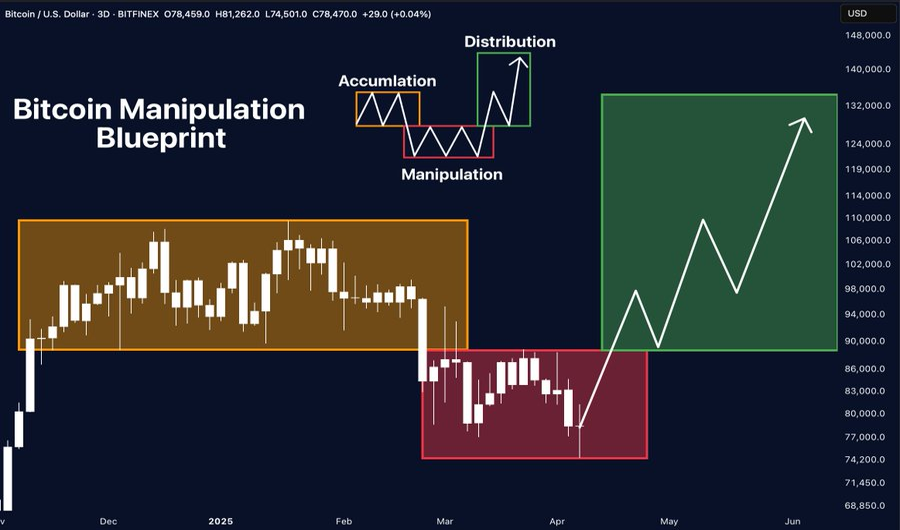

- The market stage reveals the transition from manipulation to bull distribution zones.

Bitcoin’s present time span displays the 2021 sample, with repeated breakouts that would exceed $30,000. Technical analysts quote repetitive ranges of help and emotional cycles, that means new strikes with greater costs.

Chart Patterns reveal acquainted market setups

Bitcoin is at present steady across the main help zones beforehand marked through the 2021 integration section. The historic sample reveals sturdy gatherings following this construction, particularly when help is retained regardless of market modifications. Value motion means that comparable technical actions may drive the following bullish leg.

Latest actions spotlight the notable similarities earlier than the 2021 sample of Bitcoin surged from $30,000 to $60,000. Technical analyst Lofty has revealed an evaluation of the 2021 and 2025 time frames, specializing in value construction and key zones. Based on Lofty, Bitcoin gathered sharply after forming a strong base of almost $29,000 in 2021.

sauce: Extremely common

In his view, the 2025 value motion displays this earlier setup, with a distinct base across the similar help vary. He marked this stage within the magenta zone in each time frames, figuring out it as the idea for a possible breakout. His projection locations the following peak at almost $210,000, proven by a blue field alongside historic momentum.

Along with time-frame symmetry, the noble ones recognized a repeating four-year cycle section that strengthened this setup. He additionally outlined investor habits in accumulation, markup, distribution and decline. Based on this breakdown, present exercise is according to early markup, following accumulation and shakeout.

He additional emphasised the psychological stage from optimism to give up, noting that the current second displays a brand new optimism. Based mostly on this sequence, he hopes that market confidence will enhance and drive additional earnings. This matrix mannequin combines the motion of altcoin with the shift in dominance of Bitcoin and value modifications, suggesting future ALT rallies.

BluePrint highlights the market manipulation construction

Analyst Merlijn Merchants present further insights specializing in value manipulation levels and institutional habits. His framework divides latest Bitcoin value exercise into accumulation, manipulation and distribution zones. Every phase displays its personal value response and buying and selling habits.

sauce: Dealer Merlin

Based on Merlijn, Bitcoin was merged between $85,000 and $90,000 between November and February, forming a build-up vary. In March, costs fell sharply to $74,000, creating an operational zone that includes panic and cease loss triggers. He marked the breakdown in purple and recognized it because the intentional shakeout section.

A powerful rebound occurred in April as Bitcoin returned to its earlier vary with an enormous bullish candle. The transfer moved the value into the distribution section, with the goal increasing to $132,000. Merlijn’s construction outlines how the value stage corresponds to emotional cycles and institutional methods.