Trump’s new tariff coverage is poised to disrupt US Bitcoin mining as China, the world’s largest provider of mining gear, locations emphasis on sudden 34% export costs and pressures American miners ROI.

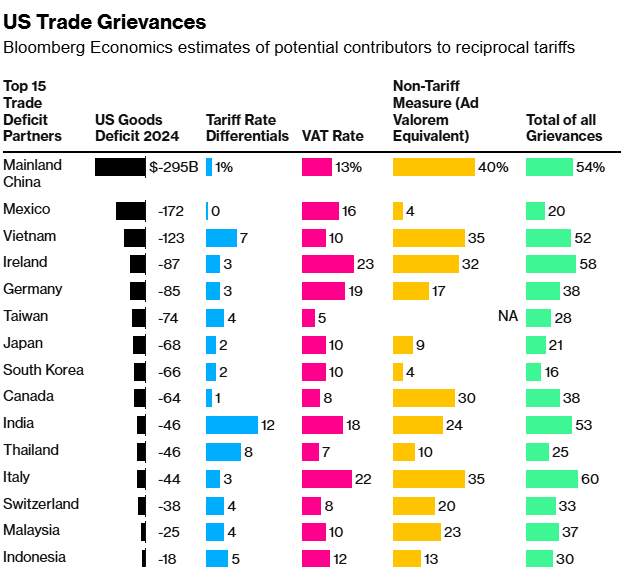

On April 2, Trump signed a drastic govt order to impose mutual tariffs on all international locations which have tariffs on US items. The fundamental tariff price was set at 10% and was scheduled to be applied on April fifth. Some international locations have confronted tariffs of 36% and 24% since April ninth, respectively.

Supply: Bloomberg

The announcement despatched shockwaves by way of monetary markets, and the crypto sector was the primary to reply. Bitcoin (BTC) fell from $85,238 to $82,526 by the tip of the day, dropping 3.18%. The broader crypto market adopted go well with, with the full market capitalization falling by about 4% between April 2nd and April third.

The US-registered crypto inventory was additionally hit arduous. Coinbase International slid 7.7%, whereas MicroStrategy inventory fell 5.6% on the day of the announcement.

You would possibly prefer it too: Crypto markets are recoiled within the wake of tariffs on the discharge date

Past crypto costs and shares, tariffs are threatening to trigger main disruption to Bitcoin mining. China, a number one producer of Bitcoin mining {hardware}, is presently going through a 34% mutual tariff on exports to the US.

“Lately, the US has emerged as a precedence vacation spot, not merely due to power prices, however as a result of it offered authorized, regulatory and financial stability,” Codestream CEO Gadi Glikberg instructed Bloomberg. “Newly imposed tariffs are unlikely to trigger large-scale escapes, however miners can delay or redirect future enlargement plans to reevaluate the long-term cost-effectiveness of scaling operations inside the US.”

With tariffs set to take impact tomorrow, Bitcoin mining gear suppliers are speeding to ship their final cargo earlier than the upper duties come into impact. Taras Kulyk, CEO of Mining Machine Brokerage Synteq Digital, instructed Bloomberg that his firm is in a rush to advertise the supply of hundreds of mining models from Southeast Asia, together with Indonesia, Malaysia and Thailand.

Amid this turbulence, mining {hardware} producers are getting ready for long-term modifications of their operations. Bitmain Applied sciences, the world’s largest producer of Bitcoin mining gear, introduced plans to open a facility within the US in December.

Traders have already priced for the long-term impression of Trump’s tariff transfer, with shares in a number of US-listed mining corporations, together with Mara Holdings and Cleanspark Inc., falling by about 10% after the announcement.

You would possibly prefer it too: Opinion: Why Trump’s “liberation day” tariffs might damage the worldwide way forward for crypto