Since hitting a brand new all-time excessive in January, Bitcoin (BTC) has struggled to determine bullish form, bringing a decline that has continued for the previous two months. In response to famend market analyst Egrag Crypto, one of the best cryptocurrencies may proceed to be revised for the following few months earlier than they begin a value rally.

Bitcoin’s 231-day cycle suggests a $175,000 goal by September

Following the preliminary value decline in February, EGRAG Crypto had assumed that Bitcoin may expertise a value correction because of the CME hole earlier than it skilled a value bounce. Nonetheless, the dearth of sturdy bullish perception over the previous few weeks has compelled us to conclude that one of the best cryptocurrencies are caught at a probably lengthy corrective section.

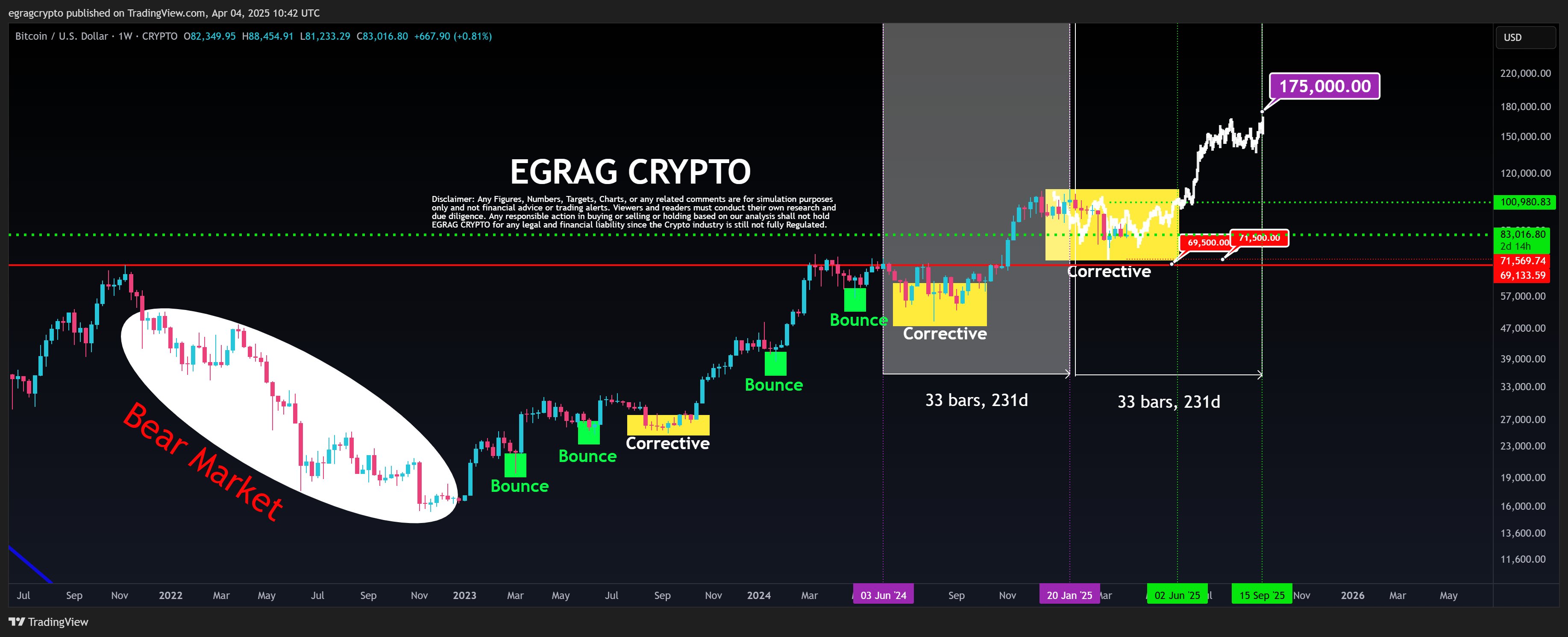

In response to Egrag, in a current submit, the continued revision of Bitcoin is in line with the fractal sample, that’s, the recurring value construction displayed over a number of time frames. This sample is predicated on a 33-bar (231-day) cycle through which BTC passes from the correction stage to an explosive value enhance.

When evaluating it to the earlier and at the moment growing cycles, EGRAG predicts that Bitcoin may emerge from its recalibration by June. On this case, analysts count on Crypto Market Chief to achieve the market prime of $175,000 by September, suggesting a possible revenue of 107.83% at present market costs.

Nonetheless, to ignite this priced rally, the Market Bulls might want to guarantee a breakout that exceeds the powerful value vary of $100,000. In the meantime, the likelihood may fall beneath the $69,500-$71,500 assist value ranges, which may disable present bullish setups and mark the top of the present bull run.

BTC traders wait when trade actions sluggish

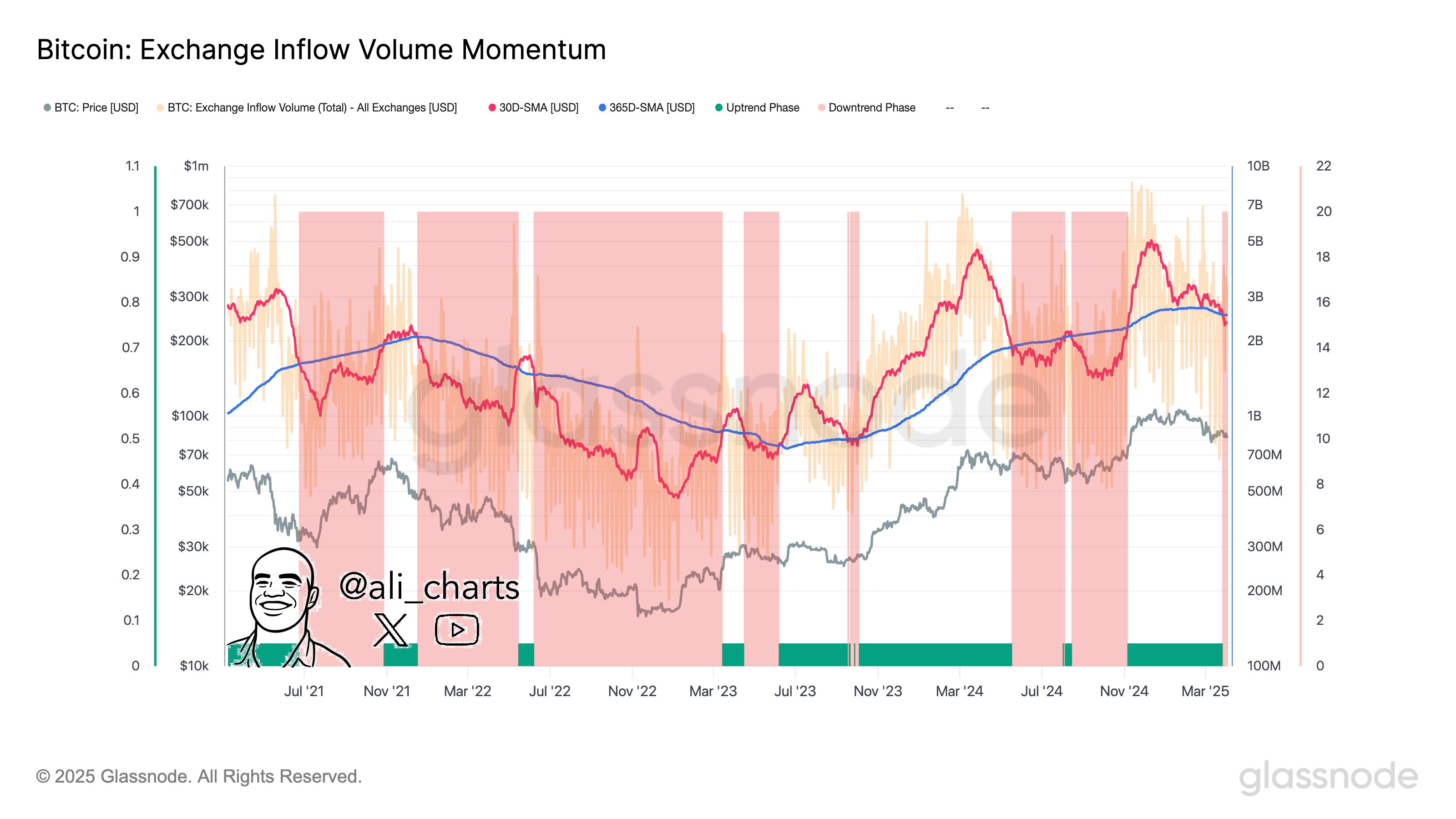

In different information, fashionable crypto knowledgeable Ali Martinez experiences a decline in Bitcoin exchange-related actions, indicating a decline in investor curiosity and community utilization. Specifically, this improvement means that traders are hesitant to deposit or withdraw Bitcoin in trade, probably as a result of market uncertainty concerning the speedy future trajectory of the belongings.

In response to Martinez, Bitcoin may endure a pattern shift as traders are ready for the following market catalyst. Specifically, Bitcoin exhibits admirable resilience regardless of the brand new tariffs imposed by the US authorities on April 2nd. In response to Santiment information, BTC costs had been solely immersed by 4% within the time because the announcement.

Since then, BTC has introduced a number of value will increase, and now buying and selling at $83,805 in a crypto market the place traders have recorded an inflow of $5.16 billion up to now day. In the meantime, BTC buying and selling quantity has grown by 26.52%, valued at $43.4 billion.

UF Information featured pictures, TradingView charts

Modifying course of Bitconists give attention to delivering thorough analysis, correct and unbiased content material. We assist strict sourcing requirements, and every web page receives a hard-working evaluate by a workforce of prime know-how consultants and veteran editors. This course of ensures the integrity, relevance and worth of your readers’ content material.