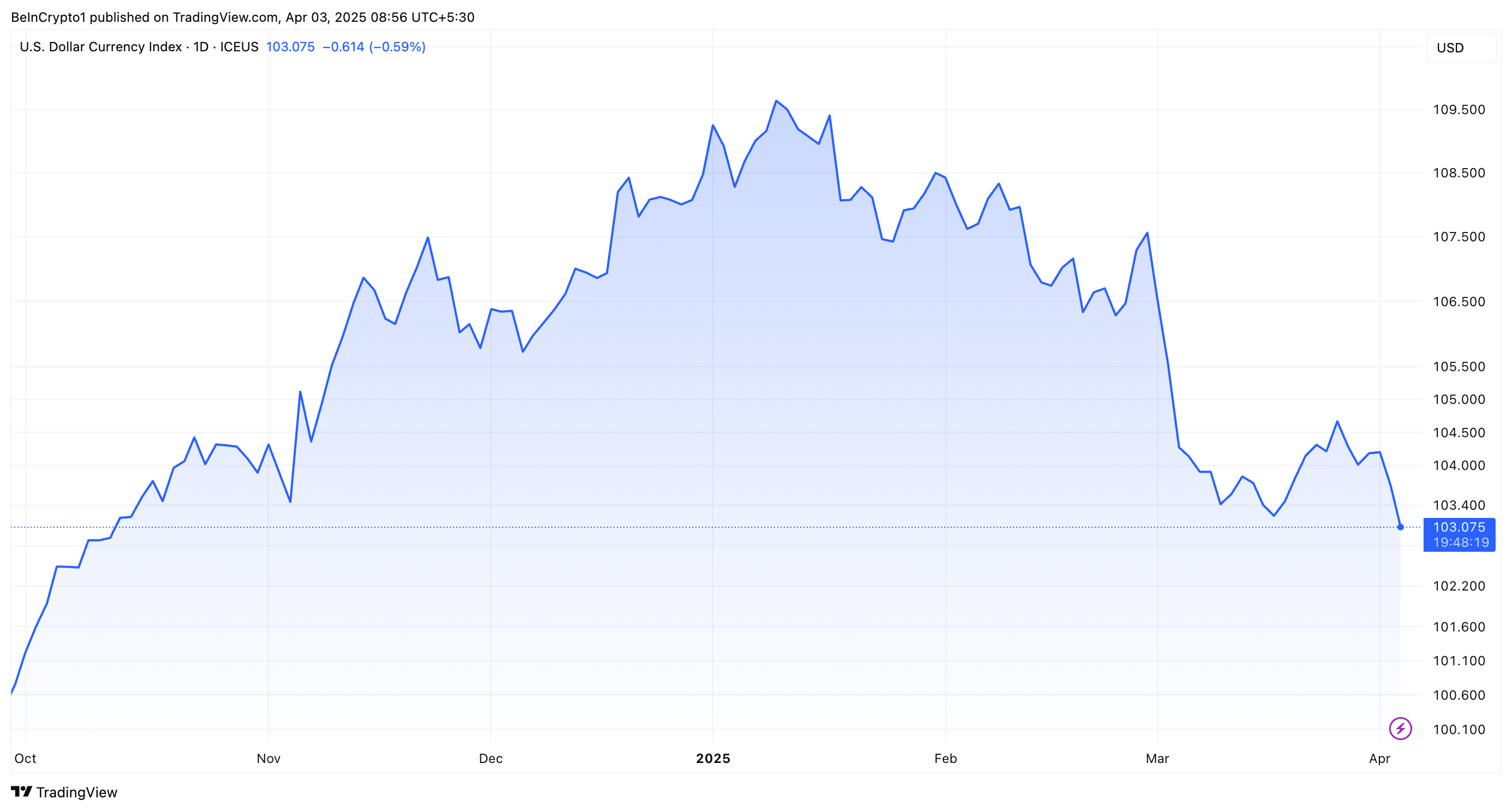

Amid the latest implementation of President Trump’s “liberation day” coverage, the US Greenback Index (DXY) has plunged to its lowest stage since mid-October 2024.

Regardless of the recession, some analysts consider the greenback’s decline can drive Bitcoin (BTC) short-term income.

Can Bitcoin profit from weaker {dollars}?

DXY, an essential measure of the US greenback’s power in opposition to a basket of main currencies, is underneath stress in a mixture of things. Rising issues a couple of potential recession and escalating tensions in international commerce have contributed to this downward development.

After reaching a two-year excessive in early January, DXY declined steadily. Moreover, it dropped nearly 4% within the first quarter alone.

US Greenback Index (DXY) Efficiency. Supply: TradingView

Economist Peter Schiff highlighted the distress of DXY in his newest X (previously Twitter) publish.

“The US greenback index has fallen to its lowest stage since October and seems to be a lot decrease,” he writes.

Schiff emphasised that the fact of weakening the greenback has the alternative impact, opposite to expectations {that a} sturdy US greenback may cut back the influence of tariffs on American shoppers. Subsequently, this can exacerbate the monetary burden from customs duties and put extra pressure on the patron.

Beincrypto reported on April 2, 2025 that President Trump had applied new “liberation day” tariffs. These mutual duties implement a minimal of 10% obligation on all imports. However, they raised issues a couple of potential world commerce warfare, additional undermining the worth of the greenback.

The Reuters report highlighted the greenback slipped in opposition to the yen. In the meantime, the euro traded at $1.08, up 0.3%, reflecting market uncertainty over the tariff announcement.

However that is not all unhealthy information. No less than it isn’t a cipher. Some market observers consider that Bitcoin may emerge as a key beneficiary of the greenback’s plight.

Ciara Solar, founder and managing associate of C²Ventures, mentioned X has elevated the probabilities of a number of Federal Reserve cuts in 2025. This transfer may additional weaken DXY and enhance the attraction of Bitcoin.

“The greenback index reveals indicators of slowing momentum and will help dangerous belongings,” Solar mentioned.

Solar’s evaluation is according to the inverse correlation between Bitcoin and the US greenback, as outlined within the Coingecko report in late 2024.

“When the greenback weakens, Bitcoin is commonly strengthened and a horny different,” the report mentioned.

Correlation between Bitcoin and the US Greenback Index. Supply: Coingecko

Bitmex former CEO Arthur Hayes predicted a big cryptocurrency rally along with Bitcoin’s bullish sentiment.

“If BTC can maintain $76,500 between April fifteenth and US Tax Day, we’re within the woods. Do not chop it up!” Hayes insisted.

The assertion follows govt forecasts that Bitcoin may surge to $250,000 by the tip of the 12 months. Nevertheless, this result’s topic to the Federal Reserve, which adopts quantitative easing (QE) to help the market.

Nonetheless, the trail forward just isn’t clear. Bitcoin might take pleasure in short-term advantages amid the droop within the greenback. Nevertheless, the great financial implications of adjusting US financial coverage and ongoing international tensions proceed to pose vital dangers.

Bitcoin worth efficiency. Supply: Beincrypto

For now, Bitcoin is feeling the influence of market uncertainty. It has dropped by 1.5% previously day, bringing the transaction worth to $83,389. Equally, the broader marked cryptocurrencies have skilled a decline, with complete market capitalization falling by 3.4% throughout the similar time-frame.