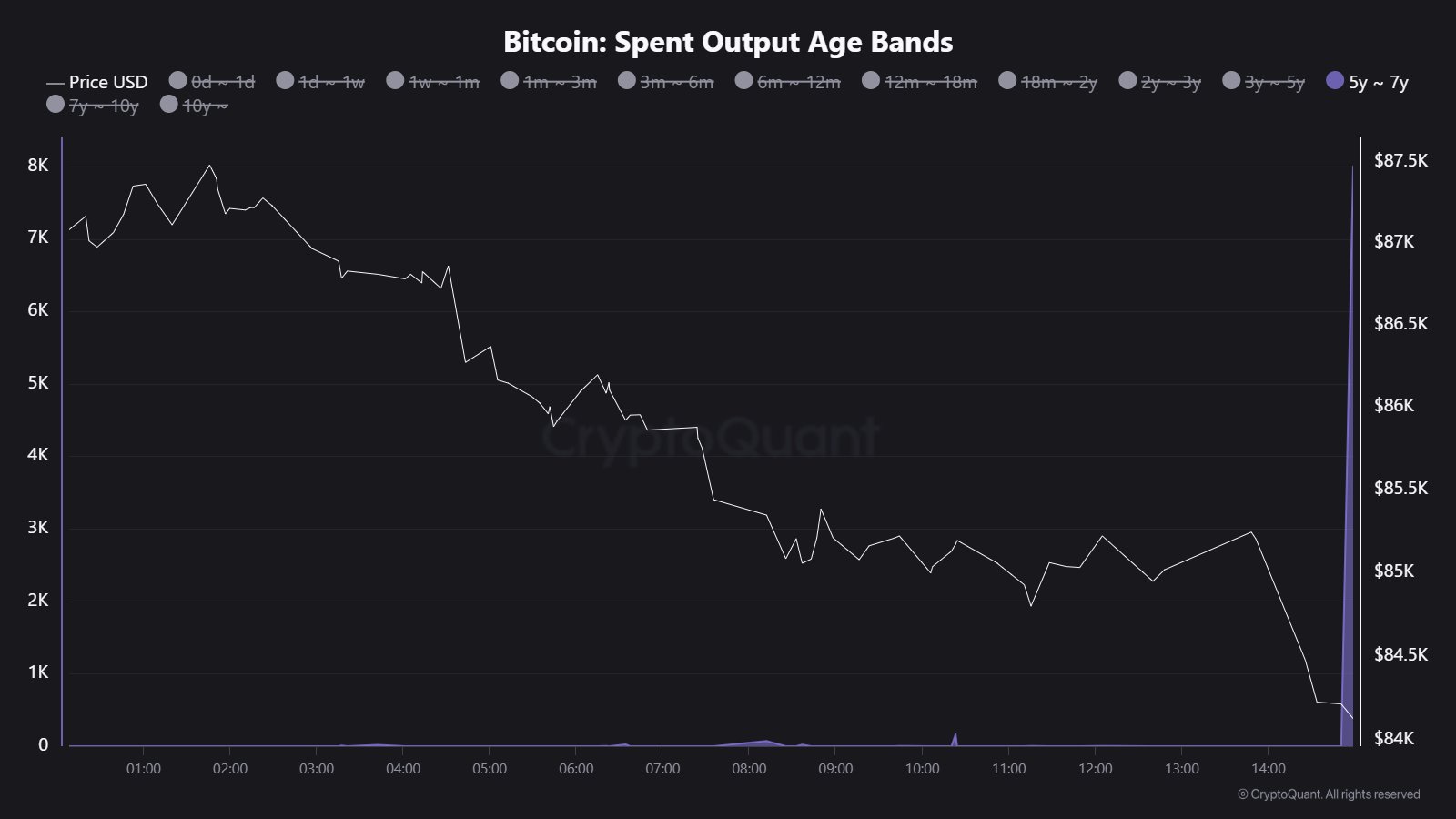

Fashionable cryptography analyst Maartunn studies that 8,000 Bitcoins (BTC) which have been dormant for 5 to seven years have immediately moved, growing the present bearish issues of the crypto. The event succumbed to huge gross sales pressures pushed by President Donald Trump’s Hawkish tariff coverage after a moderately adventurous week as BTC struggled to exceed $89,000 following the preliminary secure bullish climb.

$674 million in outdated BTC transfers in a single block – reason for alarm?

The used output age band is a vital metric for measuring how a lot time your Bitcoin token doesn’t transfer. In accordance with X-Publish’s Maartuun, the metric not too long ago revealed that 8,000 BTC price $674 million, the final transferred between 2018 and 2020, has not too long ago moved in a single block with market consideration.

This transmission follows the latest activation string of dormant Bitcoin stashes. On March twenty fourth, a 14-year inactive Bitcoin pockets immediately moved $8.5 million in 100 Bitcoins. In the meantime, in early March, six historic Bitcoin wallets additionally moved 250 BTC, price $22 million.

Specifically, the newest transactions reported by Maartuun are a lot bigger in dimension and have a probably sturdy influence on the unsure Bitcoin market. Typically, such massive quantities of BTC motion from long-term dormancy are interpreted as indicators to be topic to gross sales strain that results in main value corrections.

Nevertheless, there are different non-potential motivations behind such transactions, similar to inner pockets shuffling by institutional buyers and enormous holders, and chilly storage reorganizations. At the moment, the proprietor of the brand new pockets receiving the 8,000 is unknown, which reduces the probability of a bearish response from BTC holders.

Bitcoin value overview

On the final day, Bitcoin costs fell 4.00% after the US authorities introduced its intention to impose a 25% tariff on automotive imports and items from China, Mexico and Canada from April third.

These measures by the Donald Trump administration are burning worry of a possible financial slowdown, which might push high-risk property similar to BTC additional right down to lower-risk property from buyers’ portfolios.

On the time of urgent, Bitcoin is at present buying and selling at $83,693, reflecting a decline of 0.72% and a pair of.53% over the previous seven and 30 days, respectively. In the meantime, each day buying and selling quantity of property has elevated by 19.38%, valued at $31.5 billion. BTC’s market capitalization is at present at $1.66 trillion, nonetheless accounting for the dominant 61.1% of the crypto market as a complete.

BTC buying and selling for $83,727 on each day charts | Supply: BTCUSDT chart at tradingView.com