Three years after Ethereum’s London Arduous Fork aimed toward restraining provide development, the community stays inflationary, opposing the promise of early deflation.

The etheric deflation promise continues to be fulfilled

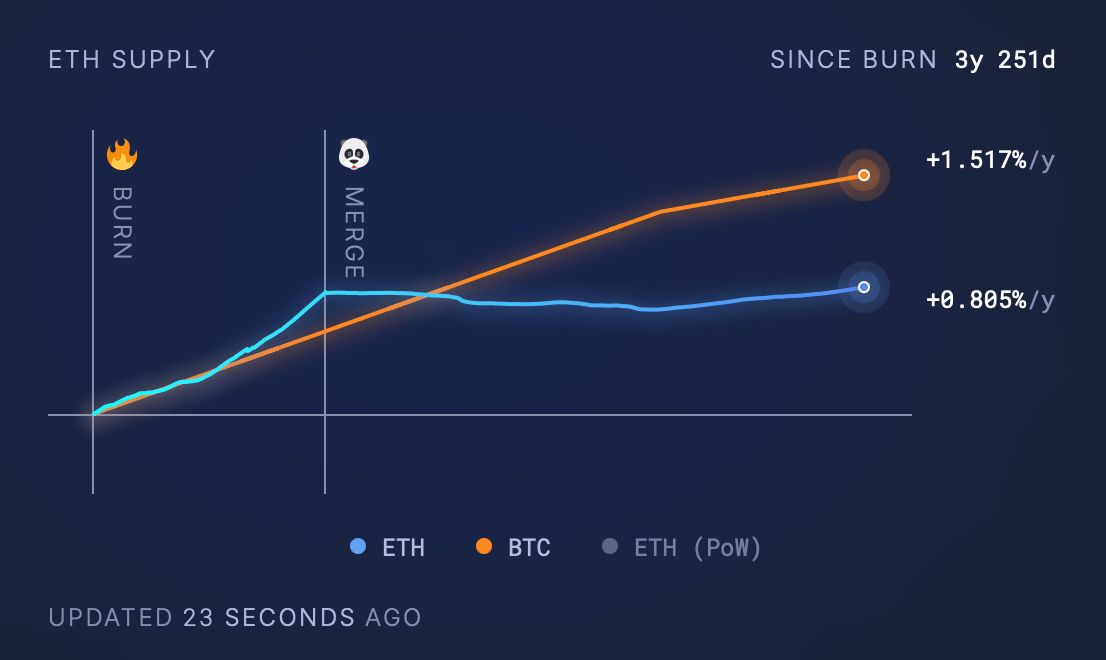

As of April 13, 2025, Ethereum’s internet ETH provide has elevated by 0.805% per 12 months for the reason that London Arduous Fork in August 2021, including 3,477,830.85 ETH to the circulation. Regardless of burning 4,581,986.52 ETH by way of the EIP1559 payment burning mechanism (the cornerstone of the improve), burn charges haven’t been in a position to constantly offset the brand new situation.

Since August 2021, $7.3 billion value of Ethereum (ETH) has been on fireplace.

Bitcoin recorded a excessive annual inflation fee of 1.517% over the identical three years and eight months, however the mounted provide cap contrasts with the ETH capless mannequin. The London Arduous Fork, applied in August 2021, launched ETH Burns as counterbalance block rewards. Nonetheless, upgrades like Dencun in 2024 lowered transaction charges and lowered burn charges.

Lowering community exercise additional leads to issuance exceeding burns as payment revenues are much more restricted. The present provide of Ethereum’s 120.69m ETH displays an annual enhance of 0.51%, contradicting expectations of sustained deflation. Based on metrics collected by ultrasound.cash. ETH transfers have led all exercise for the reason that introduction of the Ethereum burn mechanism, a complete of 374,298.59 ether has been burned.

The Unattainable Token (NFT) market continues because the second largest contributor chargeable for the combustion of 230,051.12 ether, pushed primarily by NFT transactions. Uniswap V2, which operates by way of Router 2, is carefully ranked with 226,501.32 ether burned. Tether (USDT) transactions on the Ethereum Community additionally performed a key function, leading to a combustion of 208,769.94 ether.

The common router for UnisWap accounts for an extra 153,525.44 ether, whereas UniSwap V3 by way of Router 2 burned 124,596.09 ether. Metamask’s swapp router contributes 89,489.95 ether to the entire burns, whereas one other Uniswap Common Router occasion closes the leaderboard by burning 84,388.61 ether. Asset costs have immersed 10.5% this week in $1,601, in line with wider market developments.

Though durations of deflation have occurred throughout peak community utilization at sure instances over the previous few years, constant rarity stays elusive. Advocates argue that future upgrades or demand spikes might lean ETH in direction of deflation, however present information highlights the problem of balancing burns, issuance and community effectivity. For now, Ethereum’s financial coverage as “extremely sound cash” stays an ongoing work.